ServiceChannel case study

How Cloudaware helped ServiceChannel reach audit-ready PCI DSS compliance with full AWS visibility

About ServiceChannel

ServiceChannel is a SaaS provider of facilities management software used by global brands, including Bloomin’ Brands, Cole Haan, CVS Health, Louis Vuitton, and Under Armour.

The platform connects brands with a network of 50,000 service providers and handles sensitive payment workflows, so PCI DSS controls and change discipline are part of day-to-day operations, not a yearly project.

Challenges

ServiceChannel needed to keep PCI DSS requirements under control while operating a large AWS estate. The friction showed up in the same places teams always feel it: scope, evidence, and change.

-

Visibility across AWS was not centralized. Teams could find resources, but there was no single view that stayed reliable as the environment changed, which created blind spots and made scoping harder than it should have been.

-

PCI DSS coverage was broad and time-consuming to prove. Controls touched security management, network configuration, and operating procedures, and manual checks increased the chance of missing something that would later show up as a violation.

-

Compliance monitoring relied on manual work. Tracking posture across AWS resources did not scale, and the effort grew with every new account, service, or exception.

-

Change tracking stayed reactive. Without an automated way to follow AWS Config changes against PCI rules, it was difficult to answer, in real time, what changed and whether the change introduced risk.

-

ServiceChannel needed a system that could keep inventory and PCI posture current, then turn that into evidence without a manual scramble.

Solutions

ServiceChannel used Cloudaware to anchor PCI work to a live inventory view, then run controls continuously against that scope.

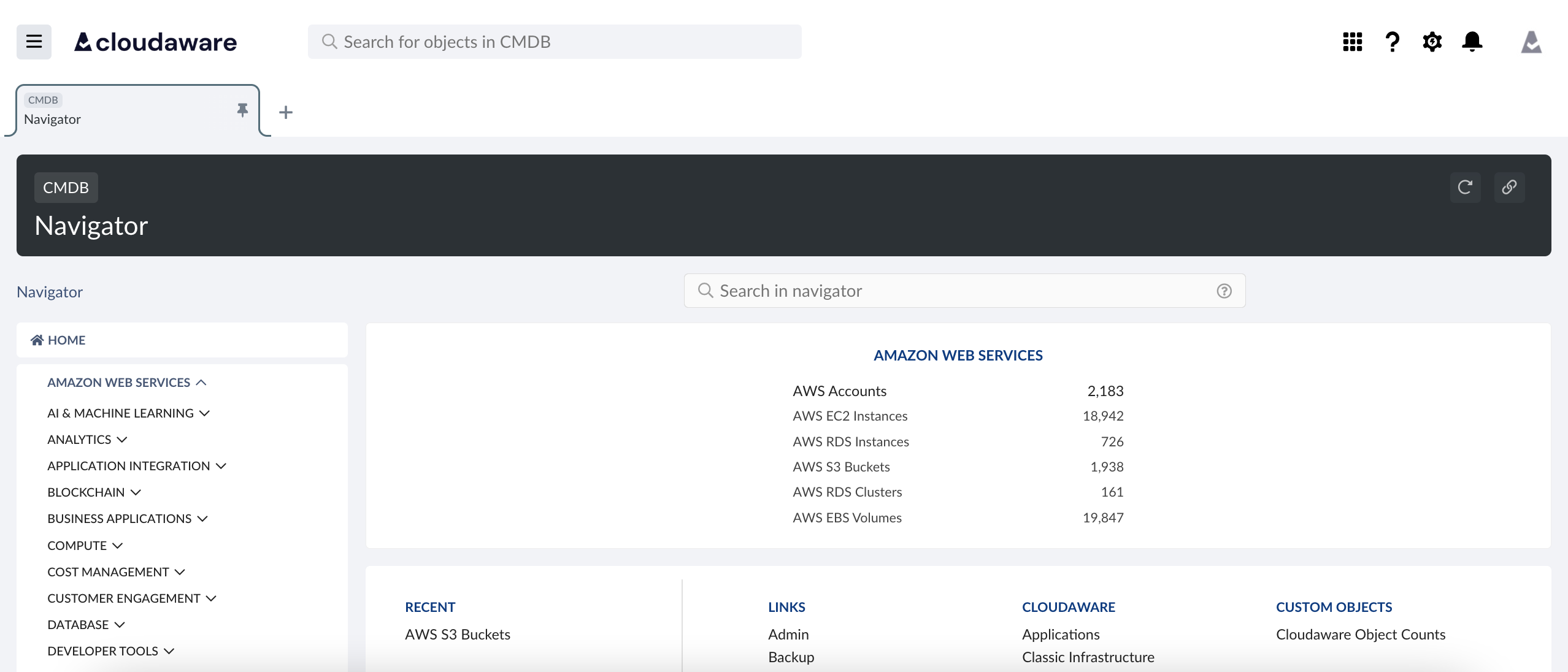

AWS inventory as a single source of truth

ServiceChannel used CMDB for AWS discovery via API integration, bringing its infrastructure into one inventory view. That made it easier to define scope, track coverage, and avoid gaps that tend to appear when teams rely on scattered exports.

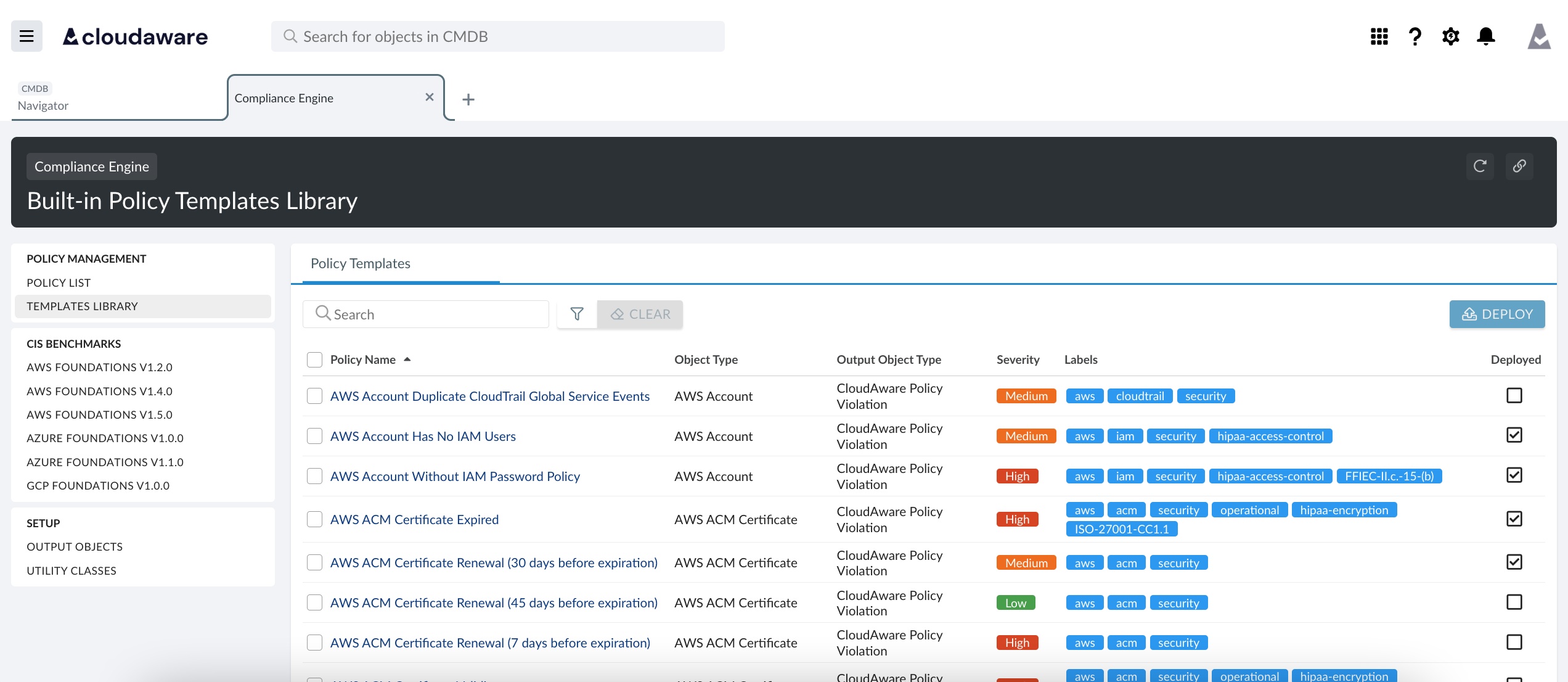

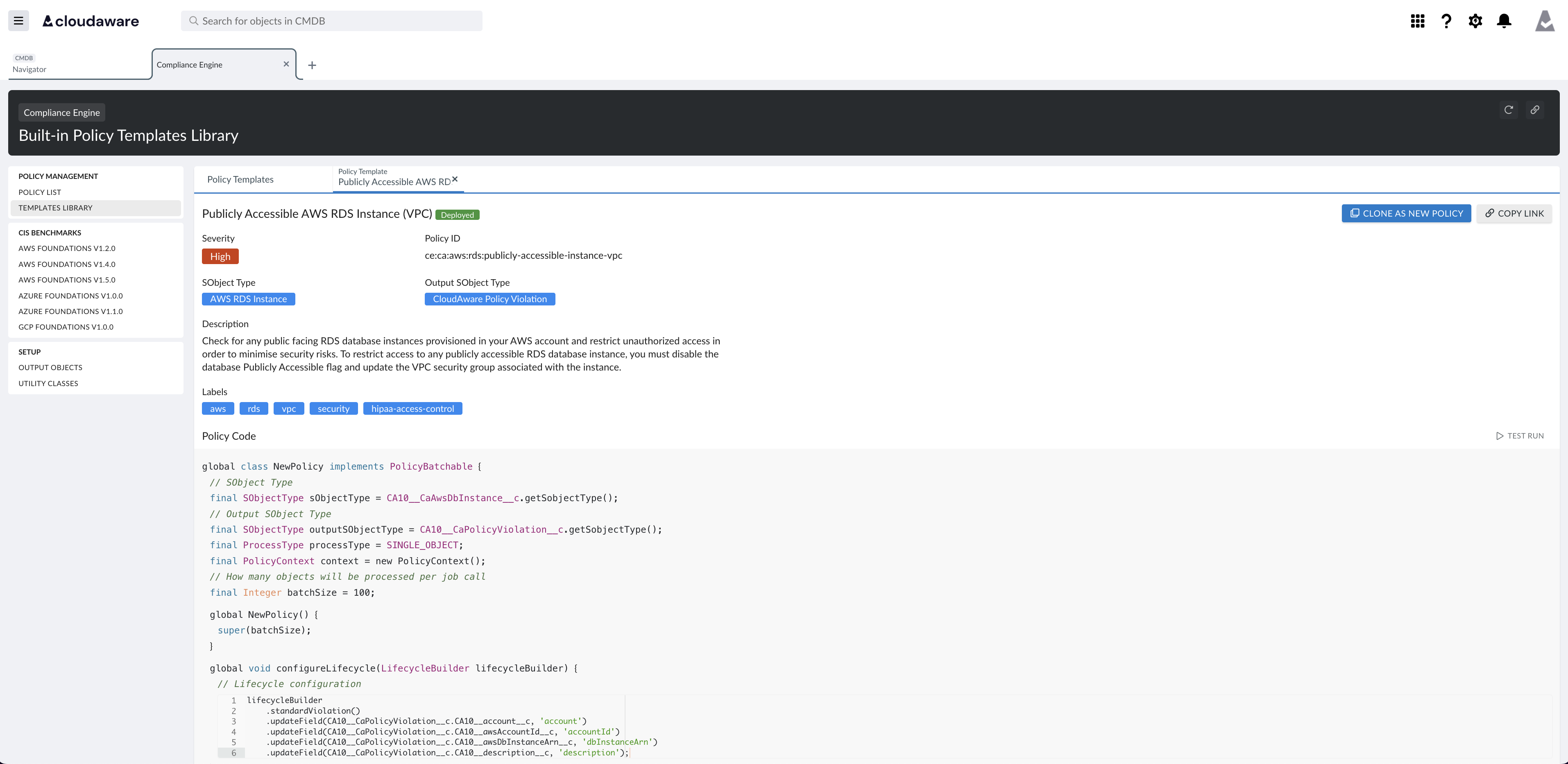

Continuous PCI monitoring with actionable findings

With IT compliance, ServiceChannel aligned monitoring to its PCI DSS framework and moved checks from periodic reviews into continuous enforcement. The module provided pre-built policies and reporting, then flagged concrete issues such as public S3 buckets and IAM credentials that were not being rotated.

Change tracking that supports audit readiness

ServiceChannel also used IT compliance to track AWS Config changes as part of ongoing compliance. Instead of reconstructing history after the fact, the team could see configuration shifts and treat them as part of the compliance workflow.

Implementation

Cloudaware went live at ServiceChannel in a rollout designed to make discovery and monitoring usable quickly.

-

Connected AWS via API to populate CMDB with a complete resource inventory.

-

Enabled Cloudaware IT compliance using pre-built PCI-aligned policies and reporting with minimal setup.

-

Turned on continuous checks for misconfigurations and policy violations, including exposure controls for S3 and credential-rotation hygiene for IAM.

-

Activated AWS Config change tracking inside IT compliance to keep posture current as the environment evolved.

Results

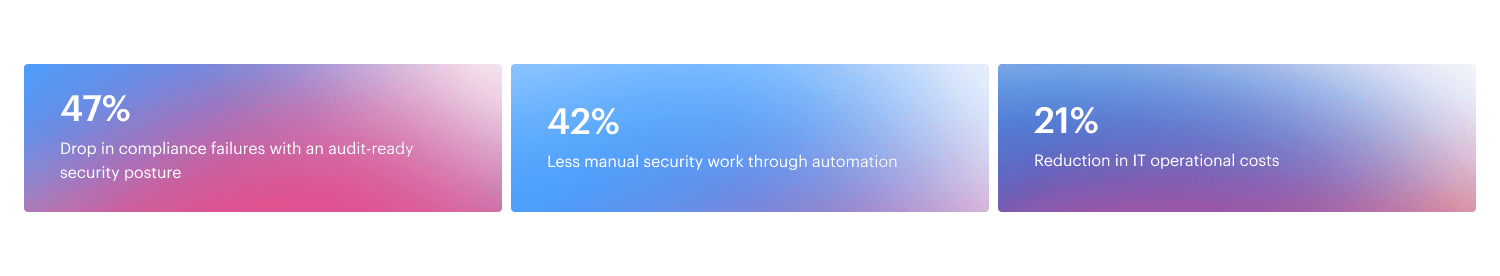

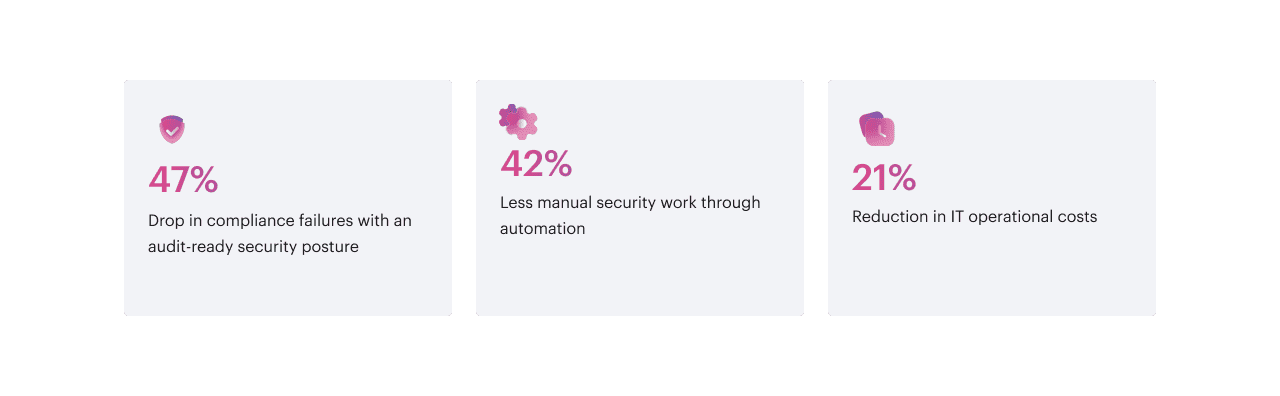

Within the first three months, ServiceChannel reduced compliance failures and cut back the amount of manual effort required to stay audit-ready.

Testimonial

“As we researched the various providers on the market, Cloudaware distinctly stood out. The solution’s ease of use and feature richness made our decision-making process simple.”

Brian Elder, Director of Cloud Infrastructure, ServiceChannel

Conclusion

ServiceChannel’s work here is not about adding another compliance dashboard. It is about keeping PCI scope and posture tied to live inventory, then running controls continuously so evidence is a byproduct of normal operations.

With Cloudaware, ServiceChannel reduced compliance failures, lowered manual security effort, and built an audit-ready approach that scales with AWS growth.

Schedule a demo to see how Cloudaware can support PCI DSS readiness in your AWS environment.

Read more case studies:

Faster Audits, Stronger Compliance Case Study

Automating PCI DSS Level 1 Case Study

Compliance Across a Multi-Cloud Setup Case Study

Any questions? Contact sales