Cloud migration costs are hard to forecast for one simple reason: the numbers that matter rarely sit where teams expect them. VM sizes and storage tiers are easy to model, but they almost never explain why a migration budget slips.

FinOps teams see this pattern repeatedly. A model looks reasonable on paper, then reality introduces friction and the run rate starts drifting. This guide walks through the cost mechanics behind that drift and shows how experienced teams structure cloud migration costs so forecasts hold up once workloads start moving.

What you will see in this article:

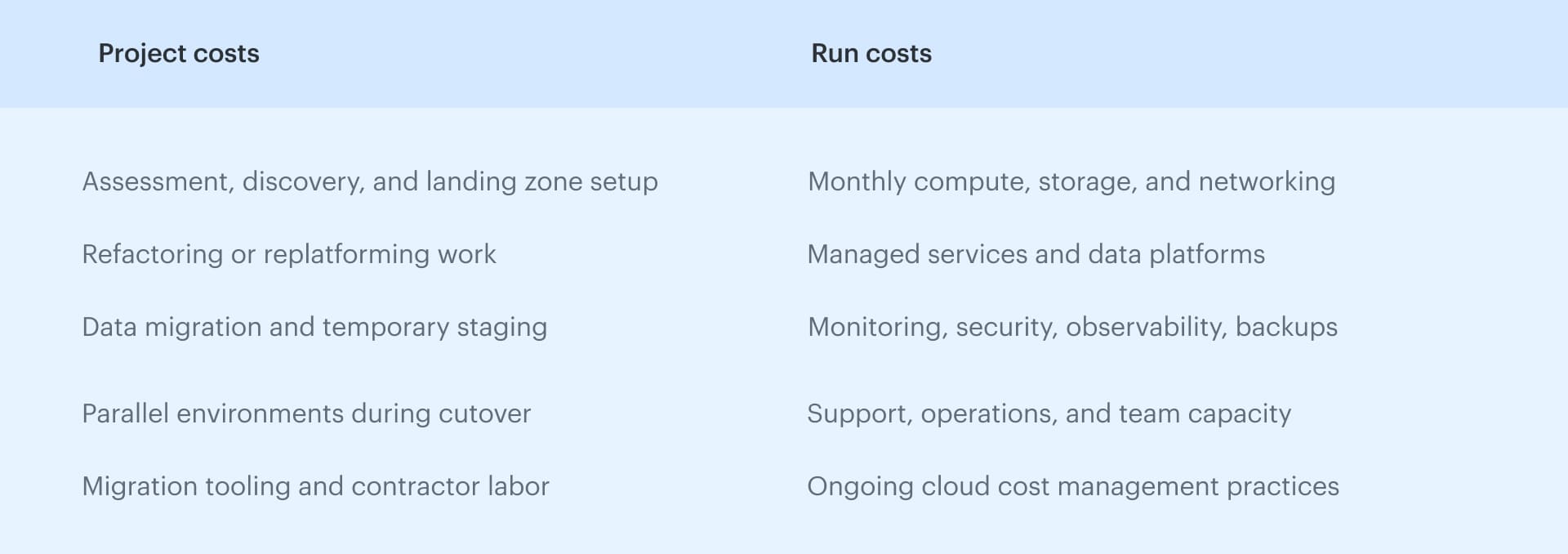

- How to separate project costs from ongoing cloud run costs

- Where migration expenses hide and why calculators miss them

- Cost drivers that break forecasts if ignored

- Cloud migration cost-saving strategies that hold up in enterprise

- Controls that keep spend predictable after cutover

Making sense of cloud migration costs

Cloud migration costs are often underestimated because the obvious items rarely drive the overruns. VM sizes and storage tiers matter, but the real spend sits in labor, data movement, temporary environments, and the operational work needed to keep systems stable after cutover.

In enterprise migrations, this effect compounds. Each workload carries owners, dependencies, compliance scope, and operational habits built over years. When those details are not fully understood at the start, both the migration budget and the steady-state run rate begin to drift in parallel.

The most reliable way to reason about cloud migration costs is to separate what exists only to move workloads from what remains as the long-term cloud bill.

The two cost stacks: project costs vs run costs

Every migration follows the same pattern:

- Project costs are temporary but volatile. These costs disappear after cutover, but they tend to spike when planning is weak.

- Run costs is your long-term cloud bill. These are the charges that determine whether the migration actually produces savings.

Keeping these buckets separate prevents teams from mixing one-time expenses with recurring cloud operational costs. It also makes the business case defensible when Finance reviews assumptions.

Why enterprises underestimate migration expenses?

- Inventories often appear complete until an untracked server or undocumented dependency shows up. At that point, sizing assumptions shift and estimates move with them

- Ownership gaps have a similar effect. When no one is clearly responsible for a workload, forecasts lose accountability. Spend drifts, corrections stall, and Finance later flags the costs as unallocated.

- Double-run lasts too long while teams plan for a short overlap. In practice, testing takes longer, approvals slip, and cutover gets delayed. The legacy and cloud stacks run together, quietly becoming one of the largest costs in the migration.

- Integration work compounds all of this. Identity systems, firewall rules, legacy databases, and audit requirements introduce effort that rarely appears in early budgets, yet touches nearly every enterprise migration.

How one-time and temporary costs affect cloud migration benefits

One-time migration costs cover the work required to prepare, move, and stabilize workloads. These costs disappear after cutover, but they determine how quickly the benefits of cloud migration show up. When this work takes longer than planned, the savings timeline shifts and the ROI model changes with it.

Foundation and data movement work that front-loads the budget

Before workloads move, teams build the landing zone: IAM patterns, network layout, encryption, logging, and compliance controls. None of this shows up clearly on a bill, but it requires meaningful engineering time and often external help.

Data movement adds another cost layer. Migrations rarely happen in one pass. Teams run multiple syncs, create temporary snapshots, validate loads, and repeat cycles during testing. Transfer charges, egress, and short-lived storage often become the biggest early spikes, especially when on-prem dependencies draw out the process.

Refactoring, tooling, and organizational work that shapes long-term benefits

The 7R framework affects both the upfront migration bill and the long-term cloud run rate. In practice, teams do not “pick an R” in isolation. The right choice comes from three constraints that show up in every enterprise migration:

- Workload behavior. Workloads with frequent change or high business impact often justify refactoring or replatforming. Higher engineering effort can pay back through lower operational cost, better scaling, or reduced support overhead.

- Business priorities. When speed is the primary constraint, rehost is usually the fastest path. In this case, teams need to plan remediation early or accept that inefficiencies will carry into steady state.

- Engineering capacity. Deep refactors only work if the organization can maintain them. A design that looks optimal on paper creates risk when teams lack the skills or time to support it.

Workloads that behave consistently over time usually land between the extremes. Moving them onto managed cloud services tends to produce the best outcome, since teams reduce day-to-day operational effort without taking on the risk of a full rewrite.

In most enterprise programs, migration work also pulls in outside help and short-term tools. Partner time, migration utilities, third-party software licenses, and team training push costs up early. None of this is permanent, but when it is missed in planning, the point where cloud savings show up moves further out than expected.

What actually drives ongoing cloud run costs

Once workloads are live, migration costs fade and the cloud run rate becomes the number that matters. This is where many teams realize the forecast they approved no longer matches reality. The issue is rarely a single service. It is how usage, configuration, and ownership evolve after cutover.

Run costs tend to drift when early assumptions go unchallenged and operational habits carry over from migration into steady state.

Compute, storage, networking, and managed services

These services form the core of the cloud bill, but the drivers are more behavioral than technical.

- Compute: instance families, autoscaling thresholds, container packing, memory pressure. Even small sizing errors compound fast.

- Storage: S3 tier selection, EBS IOPS classes, snapshot growth. Retention defaults are a common blind spot.

- Networking: inter-AZ traffic, hybrid paths, egress from batch jobs. Many costs appear only once real traffic flows.

- Managed services: DB engines, analytics platforms, Kubernetes control planes. They stabilize operations but introduce non-negotiable baselines.

Even small configuration changes can shift these cloud operational costs significantly, which is why FinOps teams monitor this category closely.

Monitoring, security, observability, and data platforms

Support tooling becomes a permanent part of the bill after migration. Logging, metrics, tracing, security scanning, and backup systems are essential, but their cost scales with retention, data volume, and integration patterns.

These platforms rarely cause immediate spikes. Instead, they grow steadily when policies set during migration are never revisited.

Support, operations, and managed services fees

The cloud bill does not include the human effort required to run the environment. Monthly run costs also reflect:

- Cloud operations and SRE teams

- Partner or managed service provider fees

- On-call support

- FinOps and cost management activities

This labor is part of the real cost of running in the cloud. When enterprises estimate cloud cost savings, this category is often overlooked, even though it has direct influence on long-term operational costs.

Read also: Top 13 Cloud Monitoring Tools Review - Pros/Cons, Features & Price

Cost drivers and hidden factors that change the entire migration model

Most migration forecasts fail for the same reason. They assume the hard part is choosing services, when the real cost pressure comes from scale, dependencies, and work that spans systems. These factors rarely show up in early estimates, but they reshape both migration costs and the long-term run rate once execution begins.

Scale, application complexity, and compliance scope

Large application portfolios always expose gaps in planning. A workload scoped for a simple rehost may rely on batch jobs, shared libraries, or reporting pipelines that were never documented. Once those dependencies surface, the migration path shifts and engineering effort expands.

Compliance adds its own friction. Encryption validation, PCI evidence, audit trails, and security approvals often take as long as the technical work. These requirements rarely appear in early estimates but influence timelines and long-term cost behavior.

Read also: Compliance Across a Multi-Cloud Setup - Case Study

Architecture, integration, and the hybrid period

Early architectural choices can lock in cost patterns that are hard to unwind. Databases placed on virtual machines for familiarity often move later to managed services to reduce operational load, triggering a second wave of migration work.

Hybrid periods magnify this effect. Cloud workloads continue to depend on on-prem identity systems, reporting platforms, or data stores. Sync jobs, temporary network paths, retries, and validation cycles introduce transfer costs and duplicated operations that were never part of the original forecast.

Read also: One IT Asset Management Guide to Rule Your Hybrid Cloud Setup

The double-run period (the most expensive phase overall)

Double-run remains the most common source of budget overruns. Teams expect a short overlap. Instead, legacy and cloud environments run in parallel while performance tests finish, edge cases are validated, and approvals move through the organization. Without firm ownership and cutover criteria, this overlap quietly becomes one of the largest migration expenses.

Read also: 9 parts of IT Asset Management Policy That Works for Hybrid Setup

Cloud workload migration cost savings 2024-2025 vs 2026

Cloud workload migration cost savings in 2024 and 2025 looked very different from what teams expect in 2026. Not because cloud pricing changed overnight, but because organizations learned where migration models actually break.

Earlier plans assumed savings would appear naturally after cutover. In practice, most savings were delayed or lost because costs became opaque during migration. Ownership drifted, environments overlapped longer than planned, and Finance had no stable way to validate whether the run rate was improving or just shifting.

Three changes now define how enterprises approach migration cost savings in 2026.

What will change in enterprise migration planning in 2026

- Double-run is treated as a financial risk, not a scheduling detail. Teams no longer assume a clean cutover. Parallel environments are budgeted explicitly, timeboxed, and tracked as a risk with clear owners. This alone prevents months of silent double spend.

- Finance expects ranges, not single-point forecasts. FP&A teams now require best, likely, and worst-case scenarios tied to real workloads. They want to know which assumptions move the numbers and what breaks if dependencies surface late. One “approved number” is no longer enough.

- Allocation must work before workloads move. Tagging and ownership are no longer cleanup tasks. Without allocation in place from day one, early cloud bills land as unallocated spend and savings become impossible to prove. In 2026, migration success is measured as much by cost attribution as by technical completion.

Read also: 7 Cloud Cost Allocation Strategies from FinOps Experts

Enterprise cost model you can hand to Finance

Once teams understand where migration costs actually come from, the next challenge is turning that knowledge into a model Finance can approve and defend. This is where many migration plans stall.

Finance is not looking for a perfect number. They are looking for a model that explains why the number moves. If the forecast changes every time a dependency surfaces or an environment appears, confidence disappears fast.

The migration cost models that survive review share three traits. They are built on real inventory, they make ownership explicit, and they document assumptions clearly enough that Finance can test them.

Why most migration cost models fail review

Many models collapse because they are built too early and too abstract. They rely on averages, idealized architectures, or pricing calculators without context. As soon as workloads start moving, those assumptions stop holding.

When Finance asks simple questions — “Which workloads drive this increase?” or “What happens if cutover slips by a month?” — the model cannot answer without a rewrite. That is usually where trust breaks down.

What Finance actually needs from a migration model

A usable model does not need to predict the future perfectly. It needs to stay stable as reality changes. That means:

- Costs tied to named workloads, not generic resource pools

- Clear separation between one-time migration spend and recurring run costs

- Scenario ranges that show best, likely, and worst cases

- Assumptions that can be traced back to inventory, usage, or ownership

When those elements are present, Finance can review, challenge, and approve the model without restarting the conversation every time the plan shifts.

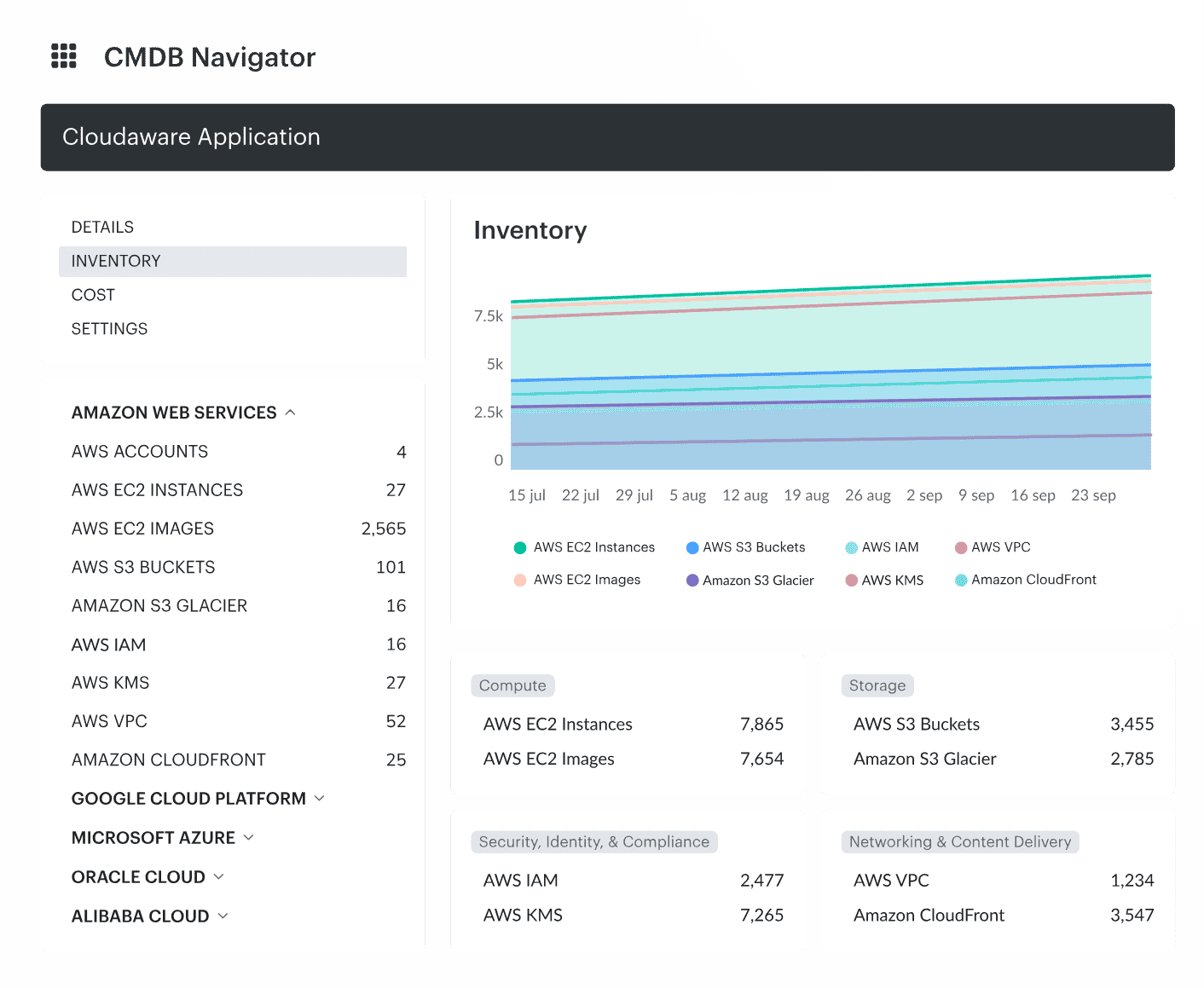

Using CMDB-backed inventory as the source of truth

A cost model only works when it reflects the real environment. A CMDB-backed inventory provides that grounding, especially in enterprise migrations where workloads span dozens of owners and environments.

- Owners. Every workload needs a clear business and technical owner. Without owners, forecasts drift and accountability disappears during cutover.

- Environments. Tagging dev, stage, prod, and shared environments ensures the model accounts for every resource, including the ones that should not move.

- App, service, infra mapping. Mapping at this level exposes dependencies early. This prevents a simple rehost plan from turning into an unexpected replatform effort halfway through migration.

- Accurate baseline from day zero. When inventory, utilization, and ownership come from the CMDB, the baseline reflects what actually exists.

This is the difference between an enterprise cloud migration forecast that Finance trusts and one that collapses under review.

Cost optimization strategies for cloud migration for enterprise

Cloud migration does not produce savings by default. Cost outcomes are set by decisions made before the first workload moves, reinforced during execution, and either locked in or lost after cutover.

Teams that treat optimization as a post-migration task usually spend the first quarters correcting avoidable mistakes. Teams that plan cost controls alongside the migration reduce waste while the environment is still flexible.

Before migration: remove cost that should never move

The cheapest workload to run in the cloud is the one you never migrate. Retiring unused or low-value applications reduces both migration effort and future run costs.

- Oversized on-prem servers should be normalized before mapping to cloud instances. Lifting legacy overprovisioning into the cloud turns historical safety margins into immediate spend.

- Tagging and ownership must be fixed upfront. Without clear owners before migration, forecasts break and early cloud bills arrive as unallocated spend.

During execution: control the messy middle

Most overruns happen here. Staging, testing, and parallel environments tend to outlive their purpose. Timeboxing these environments is one of the fastest ways to protect the budget.

- Data movement needs explicit design. Repeated syncs, hybrid traffic, and cross-region transfers often create egress costs that never appeared in planning.

- Rehost decisions are not always final. Some workloads only stabilize after a quick replatform. Delaying that decision increases redesign effort and mid-migration spend.

After cutover: shape the steady-state bill

Once workloads stabilize, attention shifts to steady-state cost control.

- Rightsizing and autoscaling should be reviewed within weeks, using real production usage. Waiting preserves migration-phase sizing.

- Commitments such as Savings Plans or RIs should follow stabilization, not precede it. Early purchases lock in inefficient patterns.

- Storage tiering, lifecycle rules, tagging, budgets, and alerts keep costs tied to owners. Without them, drift usually appears within the first 60–90 days.

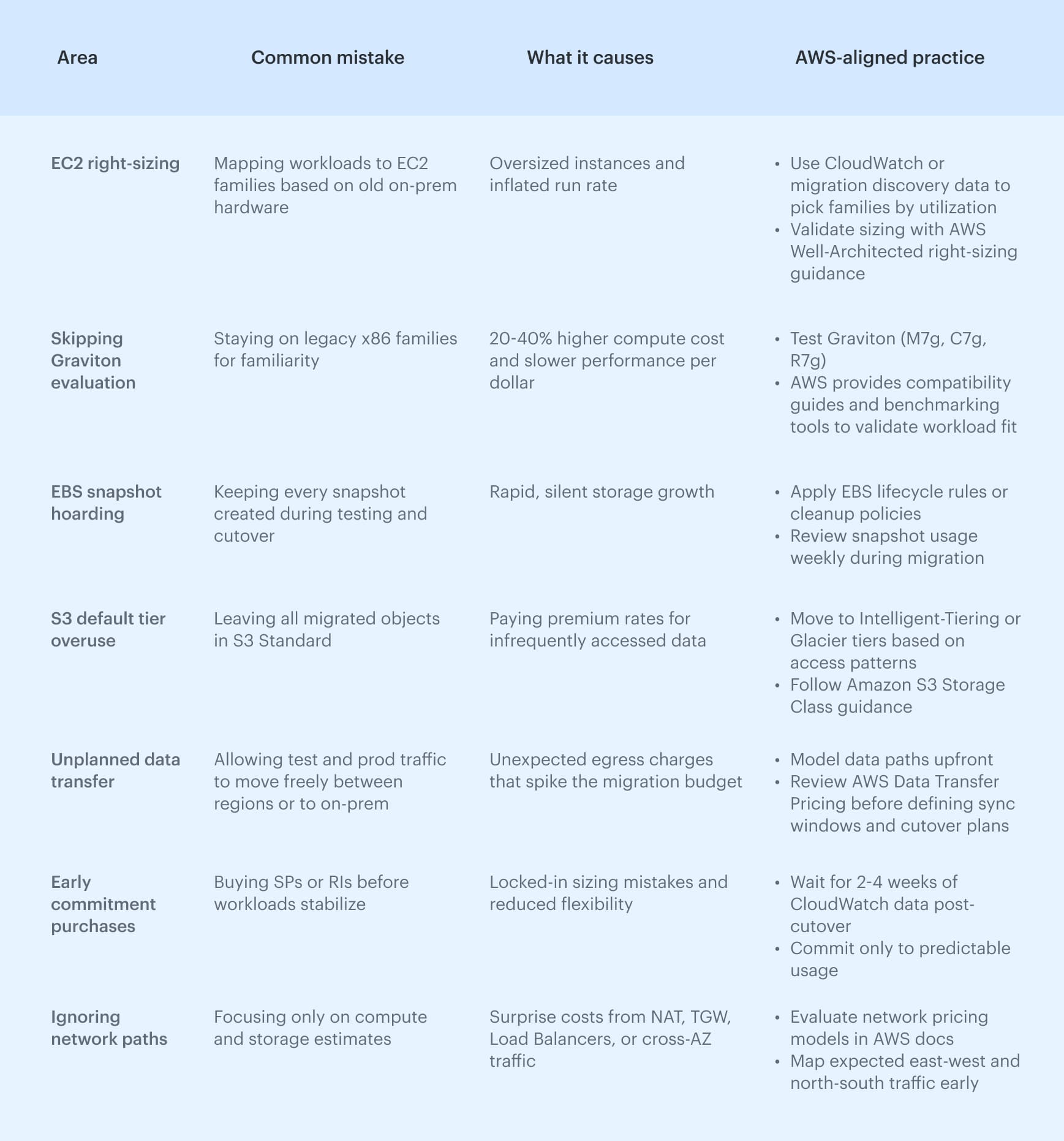

AWS-specific cloud migration costs

AWS migrations introduce cost patterns that rarely show up in early forecasts. The services are familiar, but the way they behave during migration is not. Most “first bill shock” moments come from compute sizing habits, storage defaults, and data movement that only becomes visible once workloads are live.

Compute, storage, egress, transfer, and DMS tooling

The biggest AWS migration costs usually land in a few categories.

- Compute. Workloads often map into EC2 instance families by habit rather than need. That leads to oversized instances and inflated run costs. Migration windows also create temporary compute usage for staging, validation, and lift-and-shift testing

- Storage. S3 and EBS behave differently from on-prem storage. S3 lifecycle rules are optional, not automatic, and EBS snapshots accumulate quickly during migration testing. Storage spend rises fast if teams do not clear temporary snapshots or move data into the correct tier

- Egress and transfer. Data rarely moves the way teams expect once the migration starts. A small sync job can become a noisy neighbor, and cross-region or hybrid traffic creates real costs that calculators never surface

- AWS DMS. DMS simplifies database moves, but the meter keeps running as long as CDC tasks run. Big tables and long replication windows can turn into noticeable transfer and compute costs if no one keeps an eye on them

Read also: 6 Ways to (not) Fail AWS Cloud Cost Optimization in 2026

EC2 family mapping and right-size modeling

The fastest way to overspend on AWS is to size EC2 based on hardware specs instead of utilization. CPU burst patterns, memory pressure, and IO behavior matter more than core counts.

Teams that use CloudWatch or migration discovery data to pick instance families usually end up with smaller, cheaper, and more stable configurations — especially when they test Graviton.

Read also: AWS Cloud Cost Management - A Practical Guide

Commitments strategy after stabilization

SP and RI can reduce AWS compute costs significantly, but only when purchased at the right time. Buying too early locks in migration-phase sizing, which rarely matches steady-state demand. Buying too late leaves discounts on the table.

How Cloudaware empowers cloud migration cost savings

After watching dozens of enterprise migrations up close, the pattern is always the same: teams don’t fail because they pick the wrong cloud service. They fail because the financial foundation of the migration is unstable.

Cloudaware fills that gap by giving teams a stable, unified source of truth that holds up even as architectures, owners, and environments shift throughout the migration.

Accurate baseline before migration

Cloudaware’s CMDB gives you a clean baseline before the first workload moves. Resources are tied to applications, environments, owners, and cost centers so forecasts do not start on guesswork.

Tag completeness improves because Cloudaware checks metadata across all accounts and providers and pushes exceptions back to the teams responsible.

Daily visibility that keeps costs from drifting

As the migration unfolds, cost patterns change every day. Cloudaware brings in billing and usage data continuously and links it to the CMDB to expose duplicate compute, lingering staging stacks, unplanned egress, unexpected storage growth, and early signs of double-run.

Because spend is tied to applications and services rather than raw resources, FinOps teams get actionable visibility from the first migration wave.

Governance and automation that stabilize post-cutover spend

Cloudaware applies policy and compliance controls to hold the run rate steady after cutover. Tag rules, budget thresholds, drift detection, and environment hygiene checks detect idle resources, mis-tagged assets, and footprints that inflate steady-state costs.

Considerations for cloud migration cost savings US

Most US organizations do not operate a single shared cloud environment. They run multi-account AWS, Azure, or GCP structures tied to business units, product lines, or regulatory boundaries. During migration, this adds two requirements:

- Chargeback readiness from day zero. Finance expects cloud costs to be distributed by business unit immediately after workloads move.

This means tagging, ownership, and cost-center alignment must be validated before the migration starts. If not, early cloud bills land as unallocated spend which is a major blocker for US FP&A teams. - Strong governance for account sprawl. As more teams adopt cloud services, US enterprises often see rapid account proliferation.

Without clear governance, spend becomes fragmented and savings opportunities (like Savings Plans or shared services) go unused. Migration teams now plan their account hierarchy upfront to avoid rework once workloads are live.