You're running 10, maybe 50 cloud accounts across AWS, Azure, GCP — and your finance team still chases answers in pivot tables while engineering spins up untagged resources like popcorn. Sound familiar?

You’ve got dashboards, reports, maybe even daily spend emails, but they only tell you what happened, not why, and definitely not what to do next. The root problem? Your FinOps workflows are still too human-driven in a cloud environment that moves at machine speed.

That’s where Augmented FinOps comes in.

What if anomaly detection flagged overspending before the invoice hit? What if commitment planning actually landed in Slack — not just in a quarterly doc? What if tagging, forecasts, and KPIs weren’t just tracked but improved with every sprint?

In this article, we’ll unpack:

- What makes FinOps “augmented” — and how it’s done

- Where automation makes the biggest difference (without losing control)

- What Cloudaware can already do today — and how to set it up

Let’s start with checking if we’re on the same page about the definition 👇

What is augmented FinOps

Augmented FinOps is the practice of enhancing traditional cloud financial operations with automation, real-time intelligence, and actionable workflows — so you don’t just see cloud cost data, you act on it instantly. It brings precision, context, and speed to FinOps by weaving policy enforcement, smart alerts, and cost-saving triggers directly into daily operations across engineering, finance, and product.

Without it, high cloud expenditure silently piles up — often going undetected until it’s too late to recover. By the time Finance spots a pattern, the money’s already out the door, and Engineering has moved on to the next release.

That’s why leading teams are leaning into automation-first FinOps strategies — and using tools like Cloudaware to power them.

Capabilities that power augmented FinOps

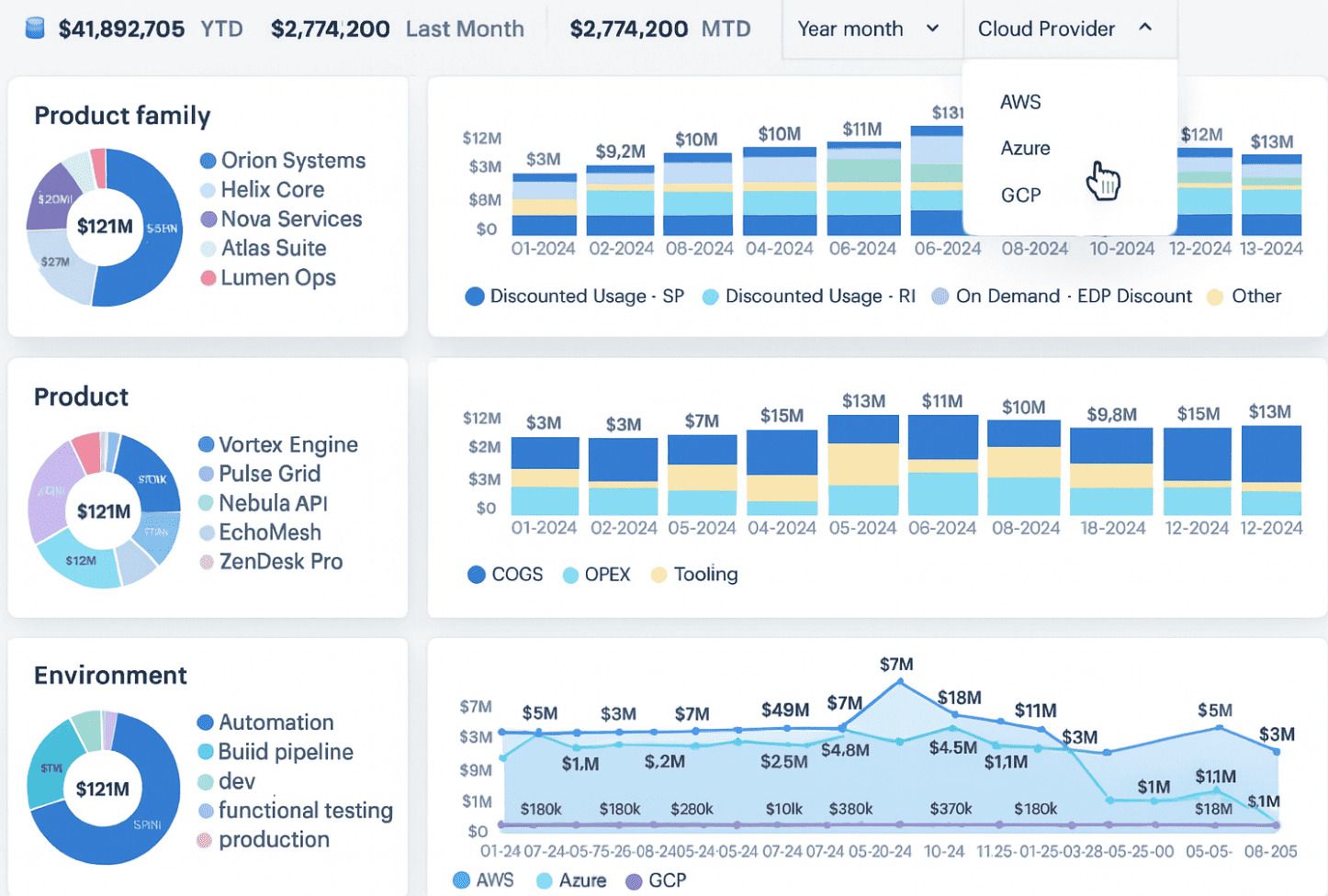

Let’s take Cloudaware platform automation for example. Here, augmented FinOps simplifies your workflow across the entire lifecycle, helping you move from lagging reports to live operational insight — and action.

Here’s what that looks like in practice:

▶ Inform: make visibility real-time

- Daily burn rate alerts scoped by scope, app, or BU.

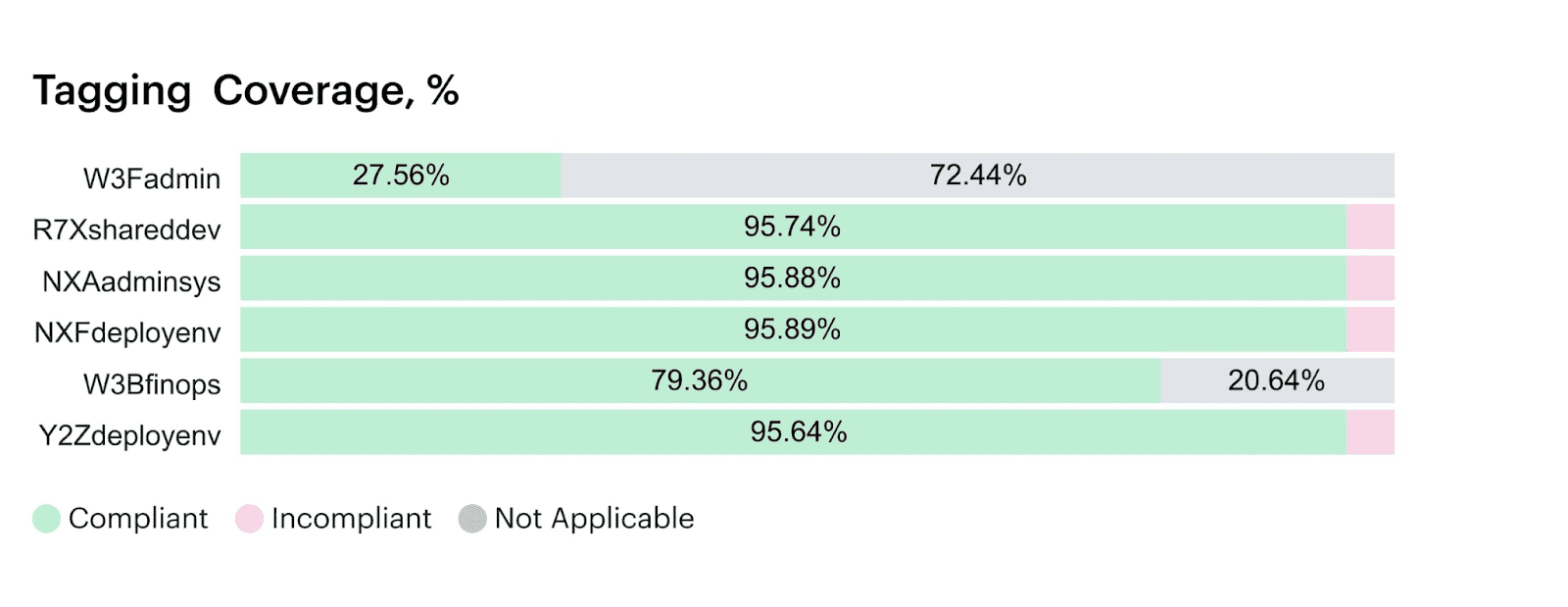

- Tagging audits and completeness scoring across all resources.

- Cross-cloud cost dashboards to monitor AWS, Azure, and GCP in one place.

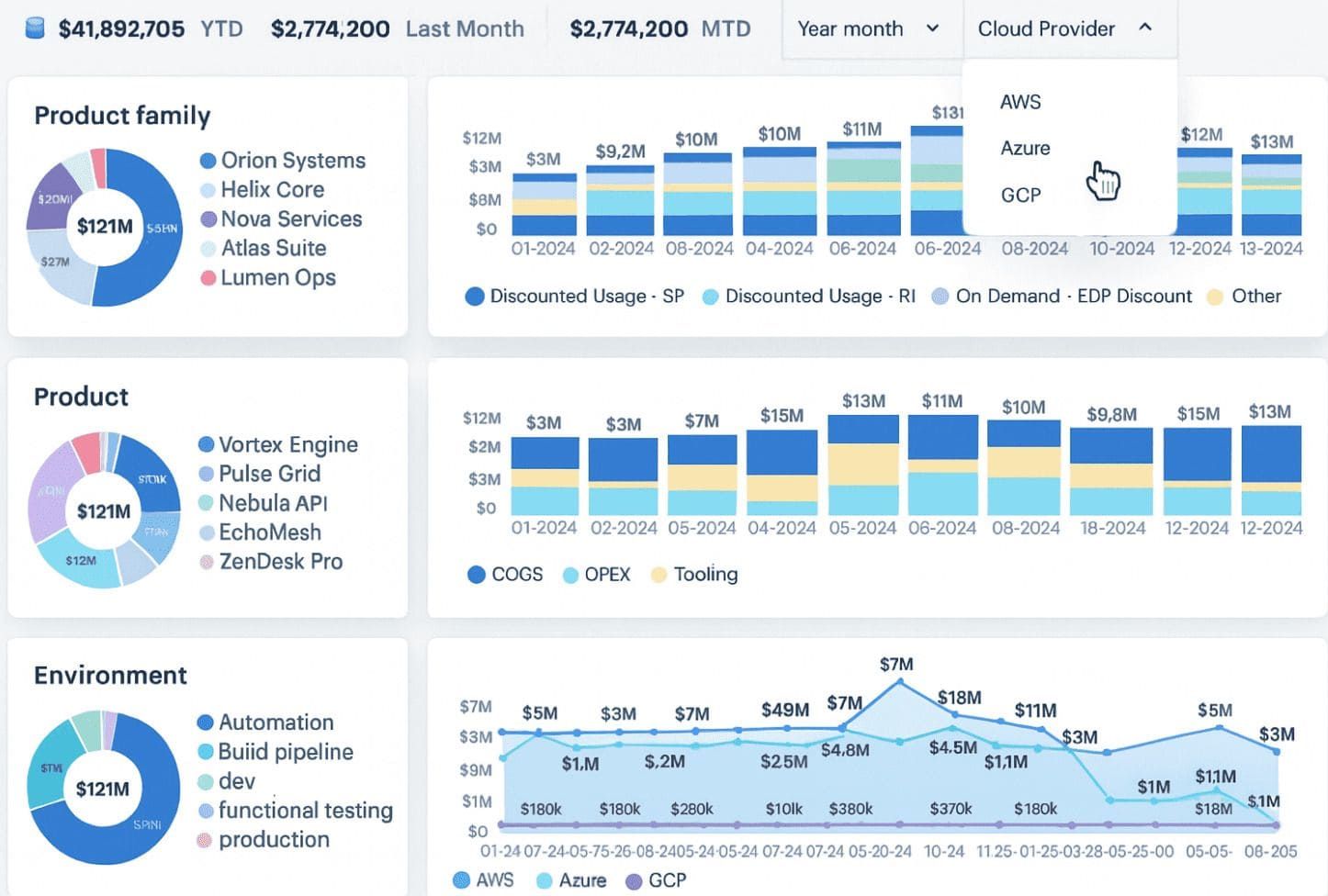

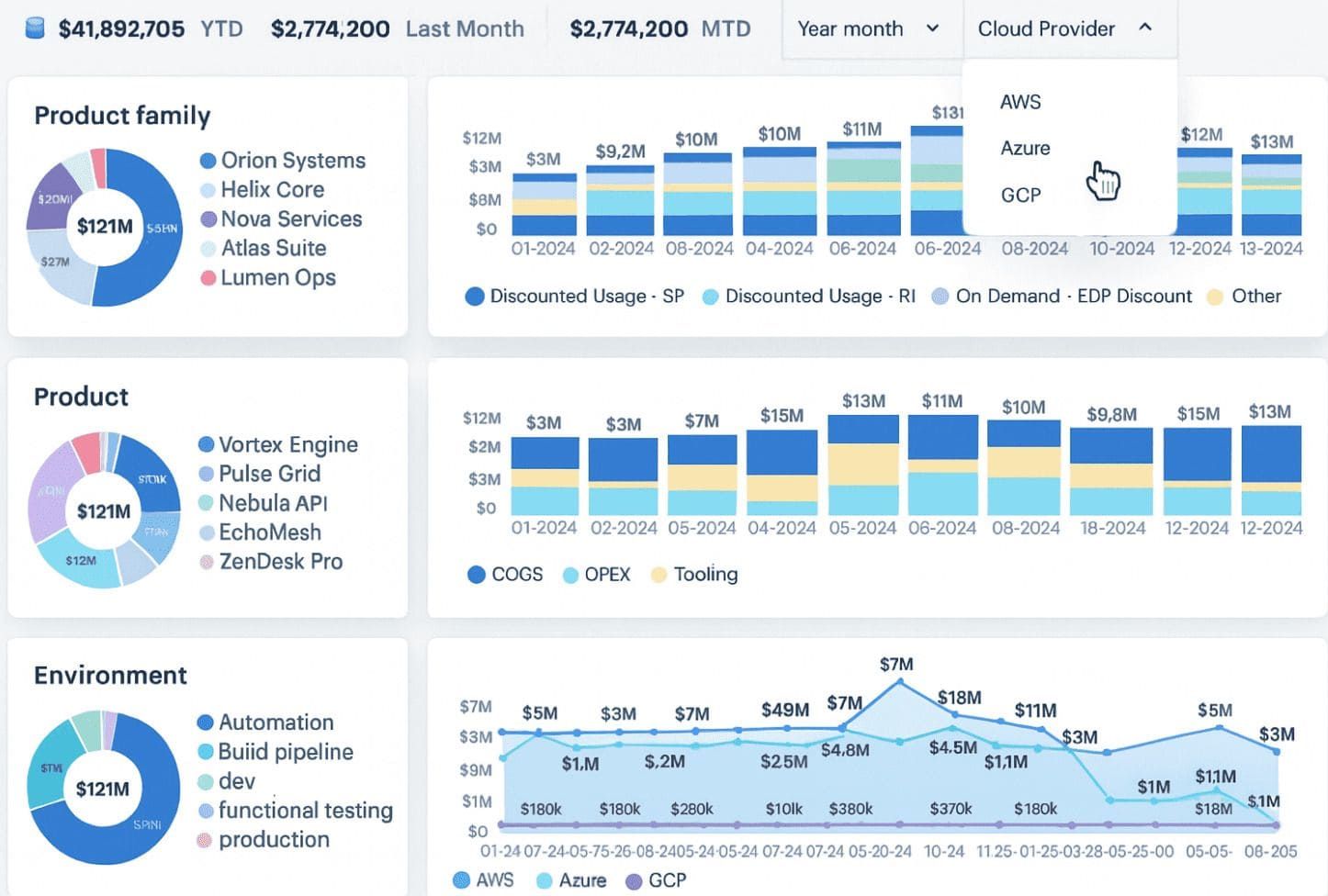

Example of the FinOps dashboard at Cloudaware. Schedule a demo to see it live.

▶ Optimize: automate the cost-saving moves

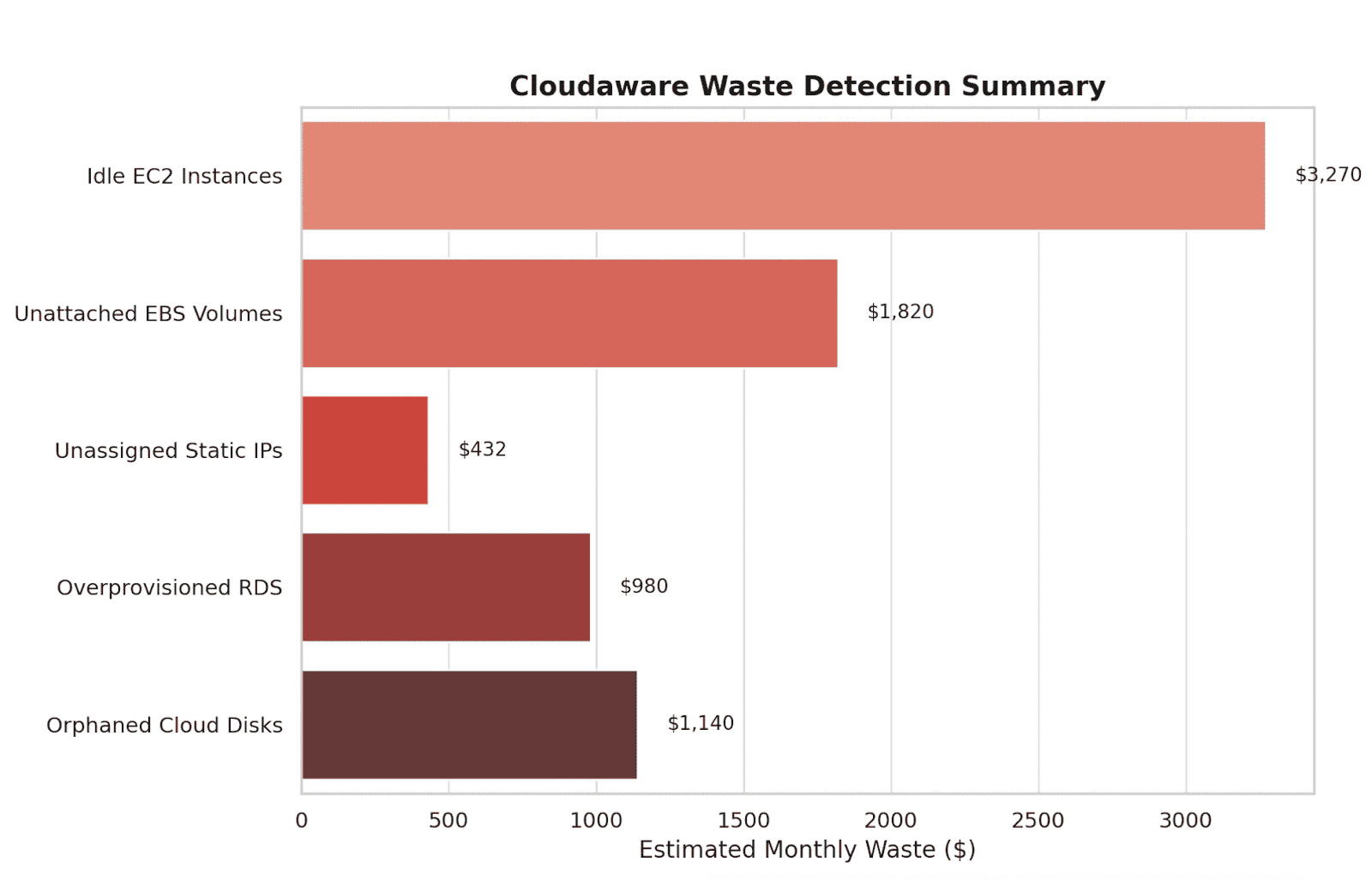

- Waste detection with 100+ built-in rules for spotting idle resources, unattached volumes, or oversized compute.

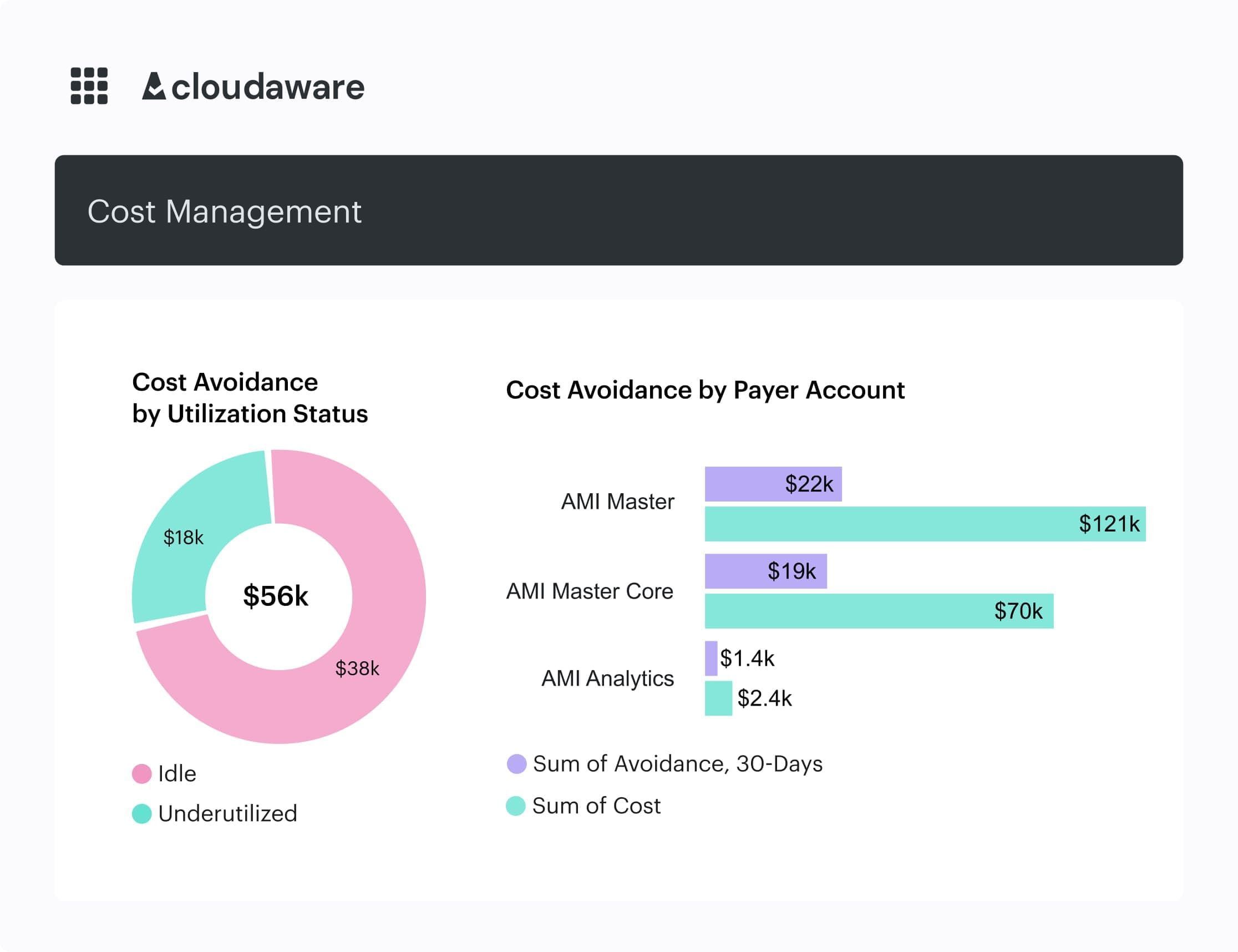

Element of the cost management report at Cloudaware. Schedule a demo to see it live. - Reserved Instance Planner that suggests commitment opportunities, mapped to real usage.

- Forecasting tools using actual consumption and scope-level insights.

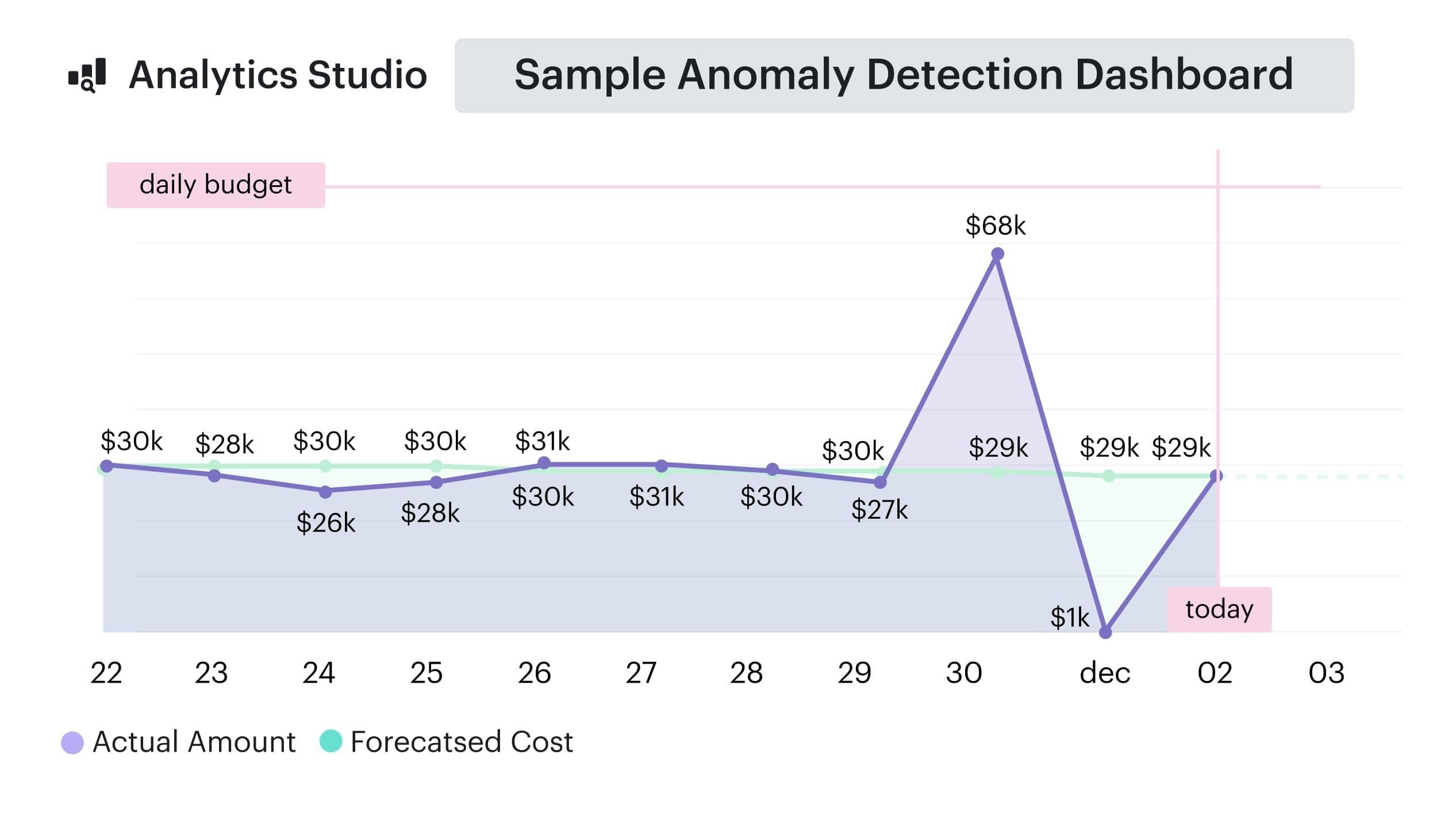

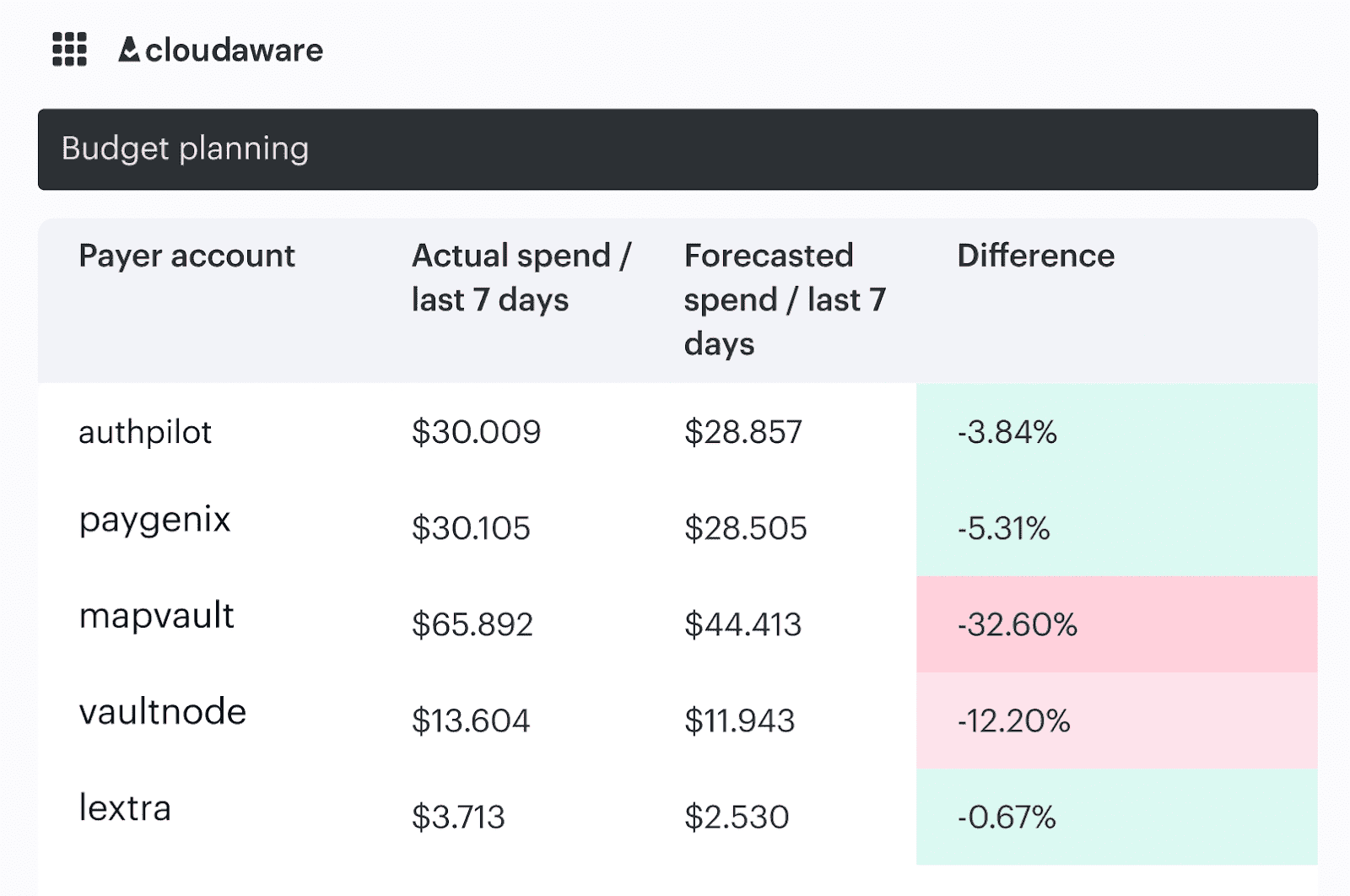

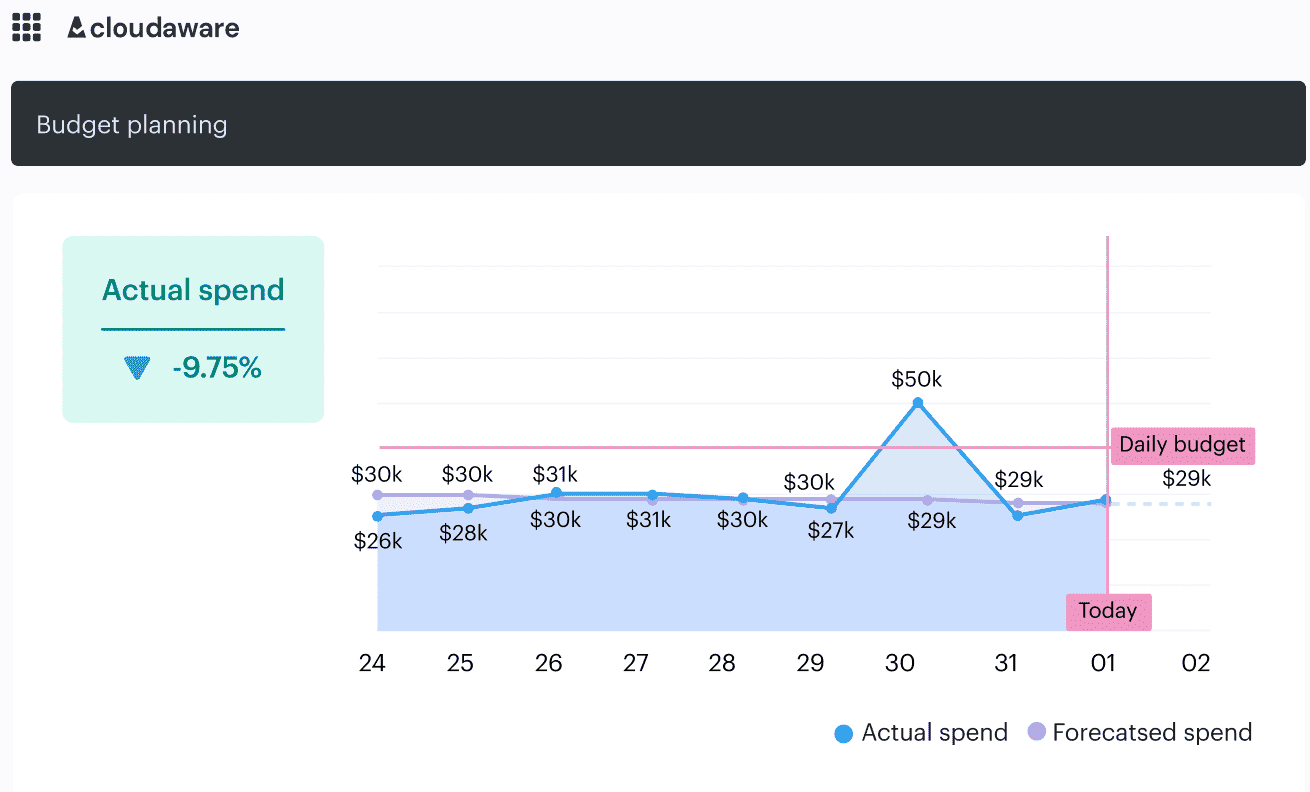

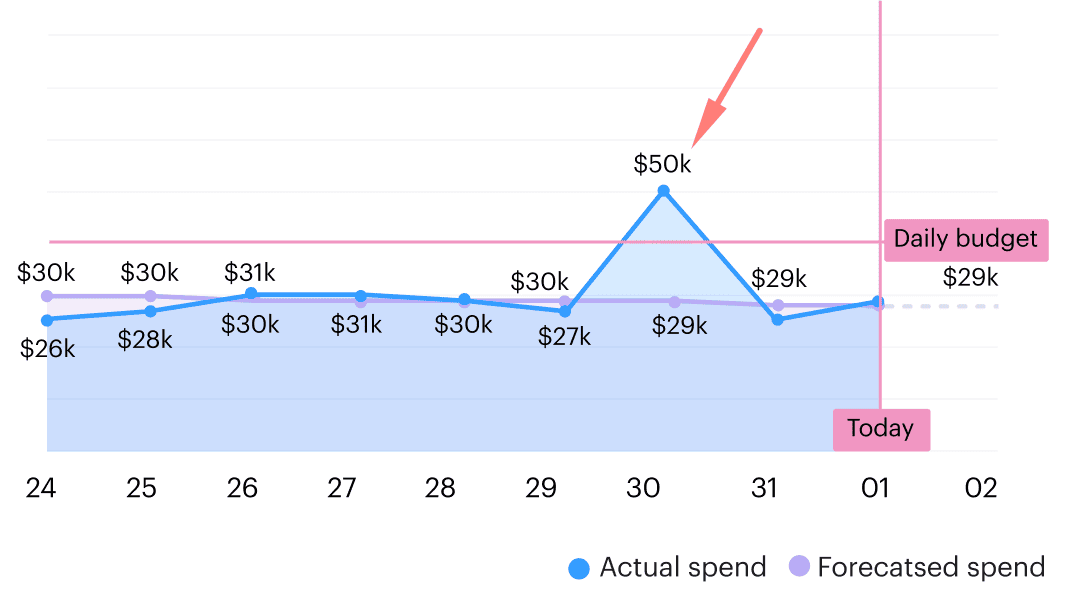

Forecasting report in Cloudaware. Schedule a demo to see it live.

▶ Operate: embed FinOps into daily workflows

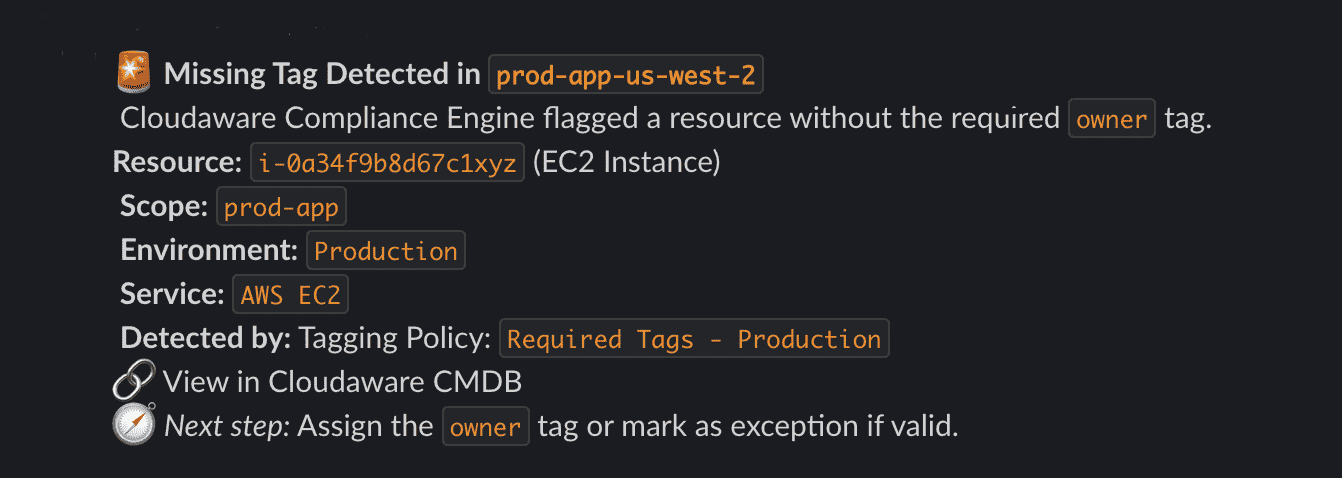

- Compliance Engine to enforce tagging rules, route alerts, and auto-open Jira tickets.

- Slack and email notifications triggered by policy violations, spend anomalies, or untagged services.

- CMDB-based ownership mapping to ensure alerts and actions reach the right team, every time.

Read also: How Cloud Experts Use 6 FinOps Principles to Optimize Costs

Real-world impact: Caterpillar’s augmented FinOps in action

Now, let’s make it real with a case from the field.

Before implementing Cloudaware, Caterpillar’s cloud architecture team struggled with fragmented visibility. Monthly spend reviews were manual. Tagging audits happened in spreadsheets. Engineering spun up cloud services with no enforced tagging.

And anomalies?

Usually caught weeks too late, after thousands were already burned.

After rolling out Cloudaware’s platform, they saw immediate, measurable change:

- Within two weeks, the Compliance Engine flagged $8,700/month in cloud waste from untagged dev resources.

- Cloudaware routed Slack alerts to the correct product team based on scope data in the CMDB — complete with direct links to the offending assets. The team resolved it the same day.

- The Reserved Instance Planner identified underutilized purchase opportunities, saving an estimated $22,000 annually — no spreadsheet modeling required.

- Reporting tasks that used to take hours each week were replaced by automated dashboards and digest reports.

If your FinOps practice still leans on static reports and tribal knowledge, it’s already behind your cloud.

But how does that actually differ from what you’re doing today? Let’s unpack the shift 👇

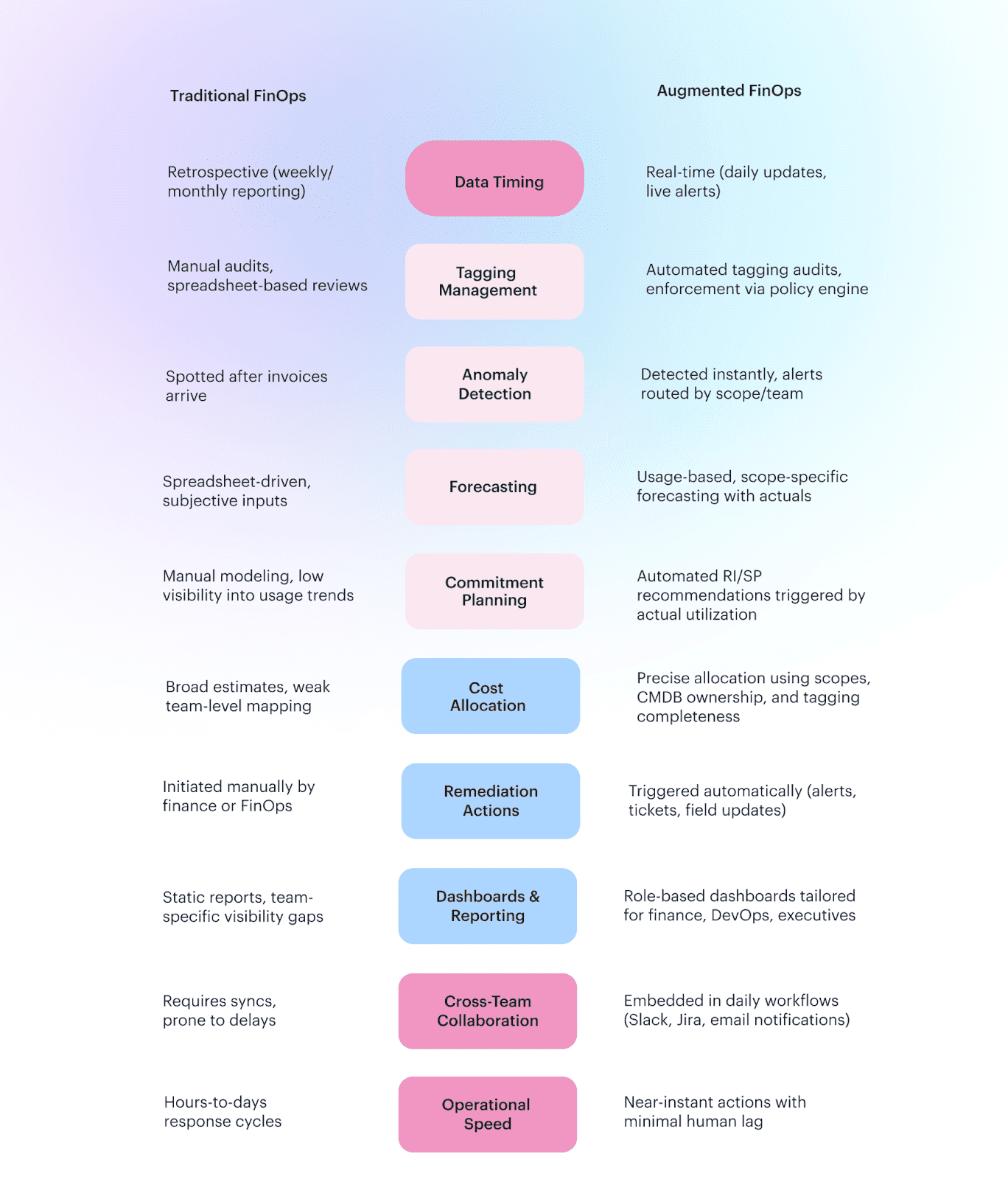

How augmented FinOps is different from the traditional

You’ve got dynamic workloads, growing cloud cost, and five teams touching infrastructure before noon — yet your finance team is still reconciling last month’s spend manually. If your FinOps practice still depends on reports that show you what happened, not what’s happening, it’s already out of sync with how cloud works.

That’s where augmented FinOps draws the line.

In traditional FinOps, you wait for finance to pull usage. You analyze spikes after they hurt. You run audits after someone complains. Everything happens late.

With augmented FinOps, action is baked in. For example, Cloudaware doesn’t just show you anomalies — it alerts the right team, scoped by ownership and application. You don’t just receive reports on missing tags — the system flags them instantly, routes the alert via Slack or Jira, and ties it back to real cloud services using CMDB context 👇

- You stop retroactively explaining cloud waste and start preventing it in real time.

- Tagging, budgeting, RI planning, forecasting — all shift from reactive effort to live signals and decision triggers. You’re not setting calendar reminders for reports. You’re building trust in automation that knows when to nudge, when to escalate, and when to step aside.

- Forecasting isn’t a spreadsheet sport anymore. It's driven by actual cloud usage patterns, scoped by team or product, monitored daily.

- Commitment planning doesn’t live in a doc. The system delivers it as recommendations based on what’s really being used, with clear actions tied to cost optimization goals.

What changes with augmented FinOps is the operational tempo. It’s the signal clarity and the ability to move from visibility to action without manual lift. Cloudaware isn’t just enabling this — it’s where it happens, every day, across your stack.

Because the truth is, modern FinOps doesn’t need more reporting. It needs fewer blind spots. And that only happens when intelligence, ownership, and automation all work together — inside the flow of your actual tech.

Read also: How to use FinOps framework: Top 10 mistakes & their fix

5 tasks companies use augmented FinOps for

Let’s talk about how companies actually use augmented FinOps — because once it’s live, this isn’t a concept anymore. It’s a working engine across finance, engineering, DevOps, and leadership. And for Cloudaware users, it’s become the system that keeps cloud cost management under control without slowing teams down.

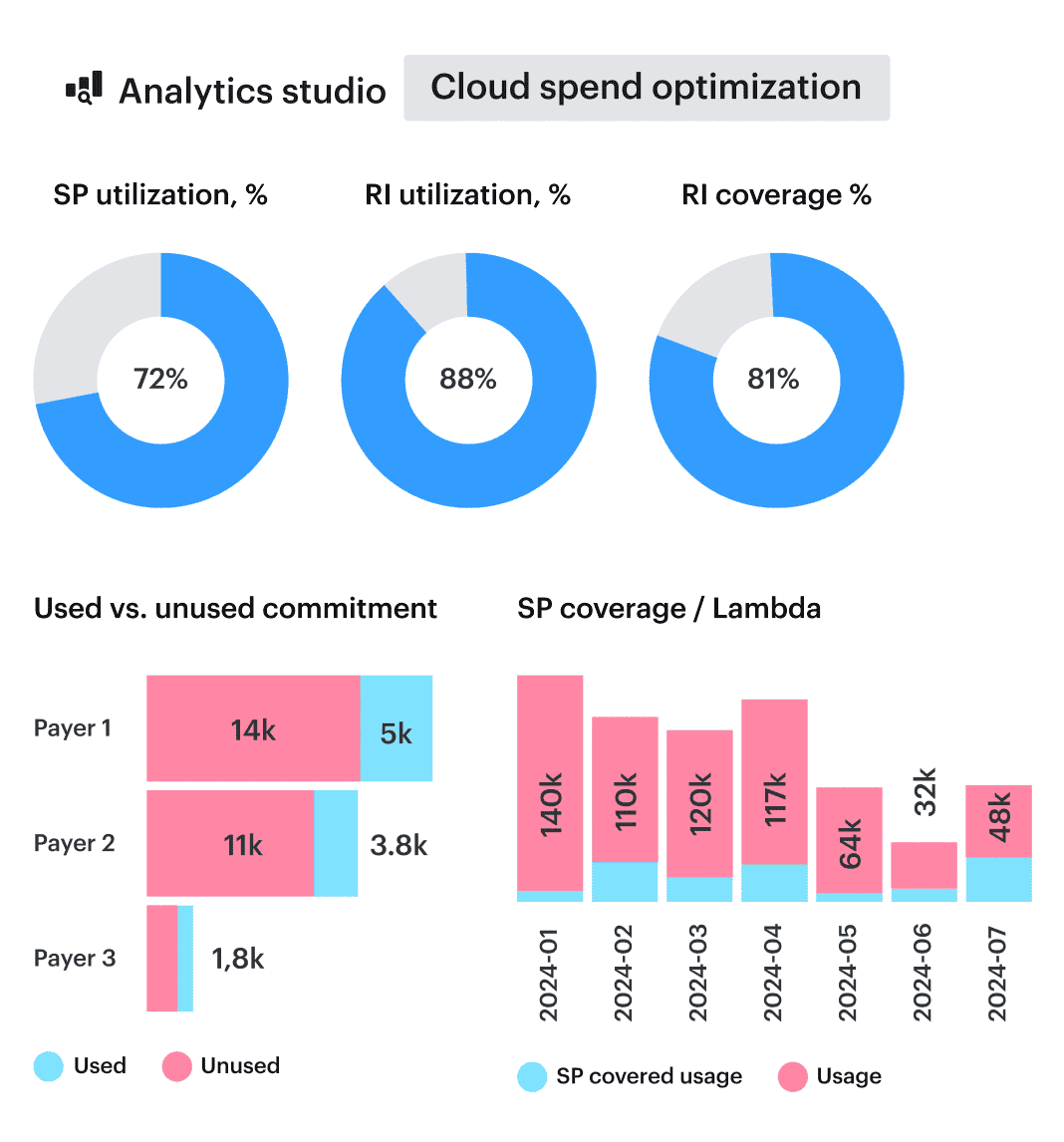

1. Automated commitment planning

Buying cloud commitments shouldn’t feel like rolling dice on next quarter’s budget. But when usage is all over the place and your forecasts are a mix of gut feel and last month’s trends, it kinda does, right?

That’s exactly why Cloudaware users lean on automated commitment planning through the Reserved Instance Planner. No more spreadsheets. No more guessing. Just real-time usage data — across accounts, workloads, scopes — constantly analyzed to surface commitment opportunities before the window closes.

Element of the cloud spent report at Cloudaware FinOps. Schedule a demo to see it live

The system doesn’t just throw recommendations into the void, either. It routes them to the right cloud architect, scoped by ownership, and usually within thresholds finance already signed off on. So it’s not “ask and wait.” It’s “review, approve, done.”

And the best part? You’re not scrambling at the end of the quarter to justify an overprovisioned fleet. You’re making smart, aligned, confident calls — backed by live data — while everyone else is still building pivot tables.

2. Real-time anomaly detection

It’s not the kind you read about in dashboards three days too late, but the real-time kind FinOps leads actually trust. Cloudaware tracks daily cloud spend across scopes, environments, and teams. The moment spend drifts outside your defined thresholds, it fires off a Slack alert or opens a Jira ticket — already scoped, already linked to the exact resources in question.

No guessing, no digging.

One Cloudaware customer shaved their anomaly response time from five days to under eight hours — without hiring another analyst, without manually hunting for the root cause. Just a clean, scoped alert delivered to the right owner, with the action baked in.

That’s not just speed — that’s control without the chaos.

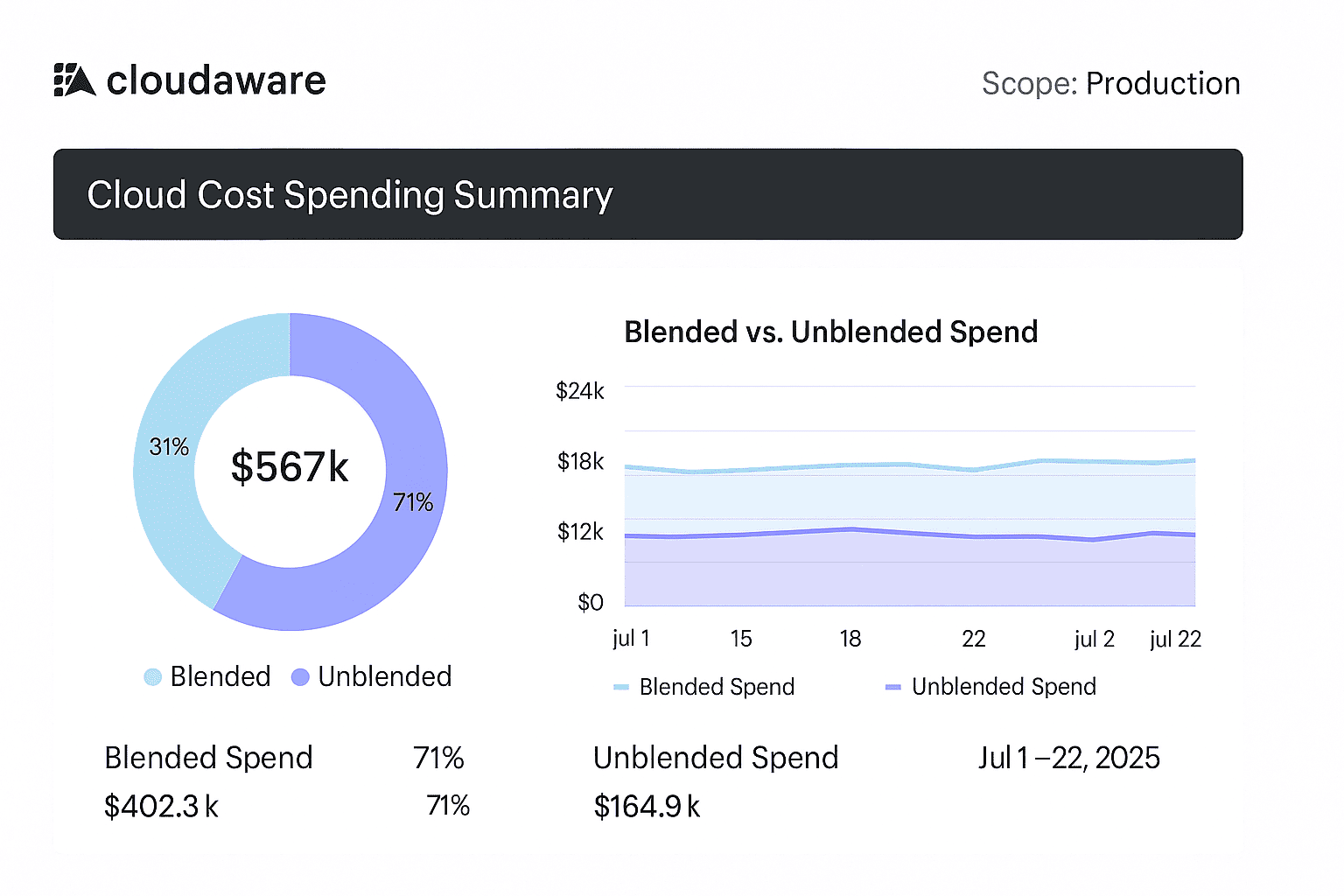

3. Auto-generated reports and KPIs per scope

You know those dreaded Friday afternoons when Finance is still digging through cloud cost data, trying to pull together something meaningful before the exec check-in? Yeah, Cloudaware users don’t do that anymore.

With auto-generated reports and KPIs per scope, the heavy lifting is gone. You set the report once — by business unit, product, or environment — and Cloudaware handles the rest. Trendlines, blended vs. unblended views, tagging quality scores, even scope-level breakdowns?

All in there. Delivered like clockwork, straight to Slack or inbox, weekly or daily.

It’s not just about saving time — it’s about surfacing real insights that teams can act on. Finance doesn’t have to chase down missing data. FinOps doesn’t have to explain every number. Product and engineering leads can finally see how their decisions impact cloud cost — without asking for access.

These reports don’t just check a box. They keep the whole cost management rhythm flowing — so by the time exec reviews roll around, you’re already ahead of the questions.

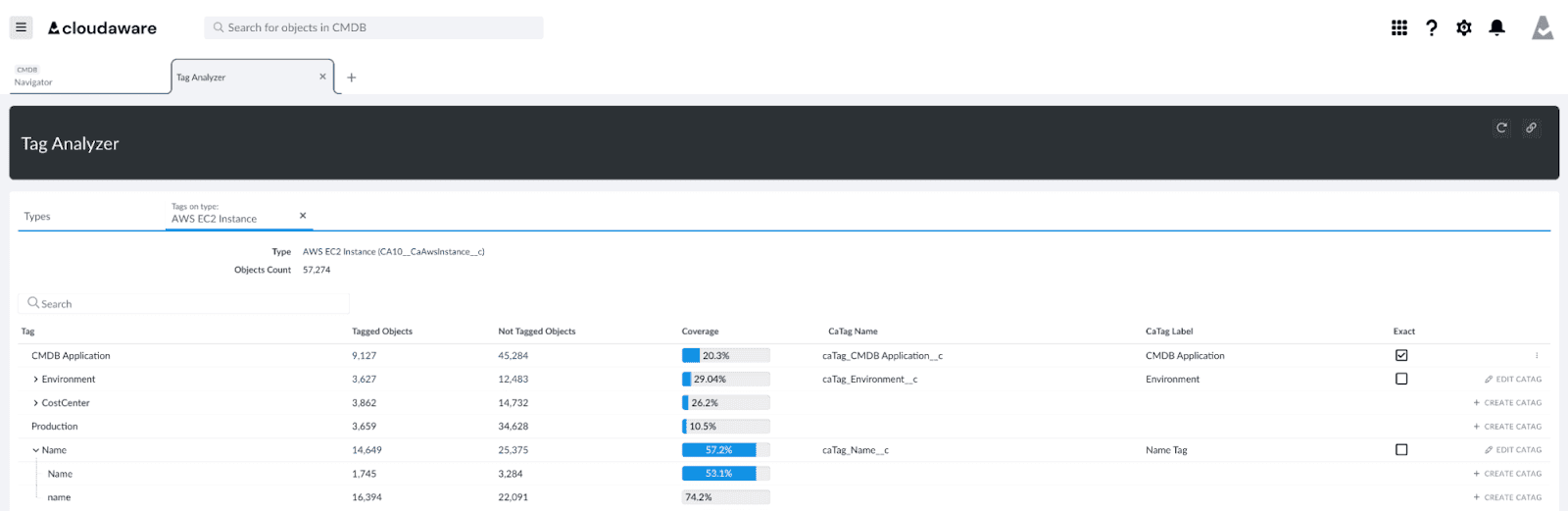

4. Auto-tagging or retro-tagging

Instead of chasing engineers or hoping folks remember the tagging policy buried in Confluence, you just set the required tags by scope — things like env, owner, product. From there, Cloudaware watches for violations in real time, flags issues, and even auto-populates fields using CMDB data. It’s tagging enforcement that actually works — without being a bottleneck.

Coca Cola cloud services team using Cloudaware saw tag completeness jump from 63% to 97% in just three weeks. And no one had to send a single “hey, can you fix this?” DM. The system handled it — clean, fast, and totally in-flow.

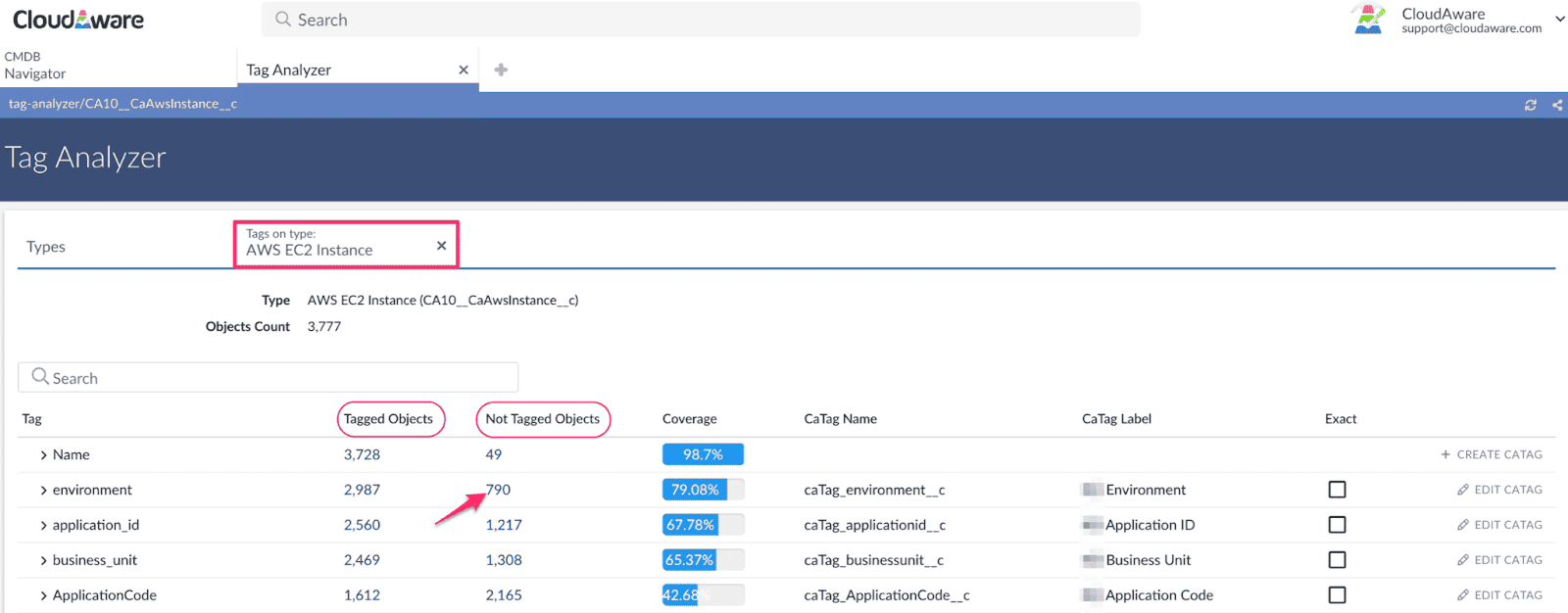

Cloudaware tag analyzer presenting CAtags. Want to see it in action? Book a demo.

Because honestly? You’ve got better things to do than chase tags. Let automation handle the hygiene so you can focus on real FinOps strategy.

5. Forecasting

And yes, forecasting is still very much alive — just not trapped in a spreadsheet graveyard anymore. Cloudaware users build live dashboards scoped to actual usage patterns across environments, products, and scopes. We’re talking real consumption, refreshed daily, broken down by team, app, or business unit — not historical averages from last quarter.

Forecast scenarios are modeled using real cloud data, not best guesses. So when Finance asks for a three-month outlook, and Engineering needs runway for new resources, everyone’s working from the same source of truth. No more weekly sync calls just to get on the same page — and way fewer “wait, that wasn’t in the plan” moments.

This is FinOps forecasting done right — dynamic, scoped, and grounded in the reality of your cloud. Because when you’ve got that kind of visibility baked in, budget alignment stops being a debate and starts being a decision.

Cloudaware budget planning report. Want to see it in action? Book a demo.

Across all these use cases, the pattern is clear: Cloudaware users aren't just watching their cloud — they're working with it. Augmented FinOps means that alerts, recommendations, and enforcement are built directly into their tech stack, routed to the right people, and acted on in time.

Because at the end of the day, the most powerful FinOps solutions aren’t the ones that give you another dashboard. They’re the ones that give you decisions — before the next cost spike hits.

How it supports the FinOps lifecycle

Augmented FinOps runs right through the core phases of the FinOps lifecycle: informing with clean, real-time data, optimizing through smart, automated actions, and operating inside your day-to-day delivery workflows.

Let’s break it down the way we actually experience it in the field.

👉 In the Inform phase, you’re not begging for billing exports or chasing down app owners for context. Cloudaware users get scoped dashboards built on live usage — not last month’s averages. Forecasts are modeled from current cloud behavior, broken down by scope, team, or business unit.

Budget planning dashboard in Cloudaware. Want to see it in action? Book a demo.

Need cloud cost reports for a chief officer? They’re scheduled, visualized, and delivered before you even check your inbox. Finance and engineering aren’t syncing to align — they’re already looking at the same set of trusted insights.

👉 Then comes Optimize. And this is where augmented FinOps becomes the grown-up version of cost optimization. With Cloudaware, you’re not just spotting high spend — you’re getting actionable recommendations:

- commitment optimization suggestions, based on actual usage,

- waste detection policies, auto-triggered when idle resources linger,

- tagging violations, flagged the second they fall out of compliance.

Tagging report element in Cloudaware. Schedule a demo to see it live

Those aren’t ideas. They’re real, scoped, and routed to the right person automatically. That’s how you reduce waste without slowing down delivery.

👉 And now we land in Operate — where most FinOps teams hit friction. But here, Cloudaware integrates directly into your delivery cycle. FinOps checks aren’t documentation — they’re embedded.

- Tagging validation inside CI/CD

- Scope enforcement before resources go live

- Jira or Slack alerts when cost-impacting changes happen mid-deploy

You’re not chasing problems after the fact. The platform catches them mid-flight, routes alerts by CMDB ownership, and lets the right team fix it before the cloud cost even hits your ledger.

This is augmented FinOps fully embedded in your tech stack. Not more meetings, not more reports — just fewer blind spots, cleaner decisions, and faster alignment across every layer of your cloud services.

Because real FinOps isn’t about keeping up with spend — it’s about staying ahead of it. And Cloudaware makes sure you do, without breaking your flow.

Read also: Cloud Cost Optimization Framework - 11 Steps to reducing spend in 2026

3 “Why” you should implement augmented FinOps

Every day you wait for a report, someone’s spinning up untagged resources your budget will inherit. Every delayed commitment decision? That’s savings lost forever. And every unnoticed anomaly? Quiet cloud waste stacking up while you’re chasing context.

Because let’s be real — the pace of cloud isn’t slowing down. And traditional FinOps can’t keep up with services that change by the hour and ownership that shifts with every deploy.

That’s exactly why teams are turning to augmented FinOps — to reduce manual work, increase precision, and bake cost awareness into how they run the business. And no, it’s not about giving up control. It’s about removing delay, uncertainty, and reactive cleanups — and replacing them with decision-ready clarity.

You’ve got questions. Let’s walk through them.

Will this reduce manual work?

Yes — and dramatically.

Cloudaware users automate tagging audits, scope-based cost reports, and forecasting dashboards that update daily. One team I worked with cut 7 hours of manual Excel work per week by delivering cost optimization reports straight to finance and engineering via Slack — scoped, filtered, and tied to real resources.

Will I lose control or transparency?

Not even close.

You define the rules. You set the thresholds. Cloudaware routes every alert, action, and exception through workflows you configure. Augmented FinOps isn’t black-box automation — it’s a control system with the lights turned all the way on.

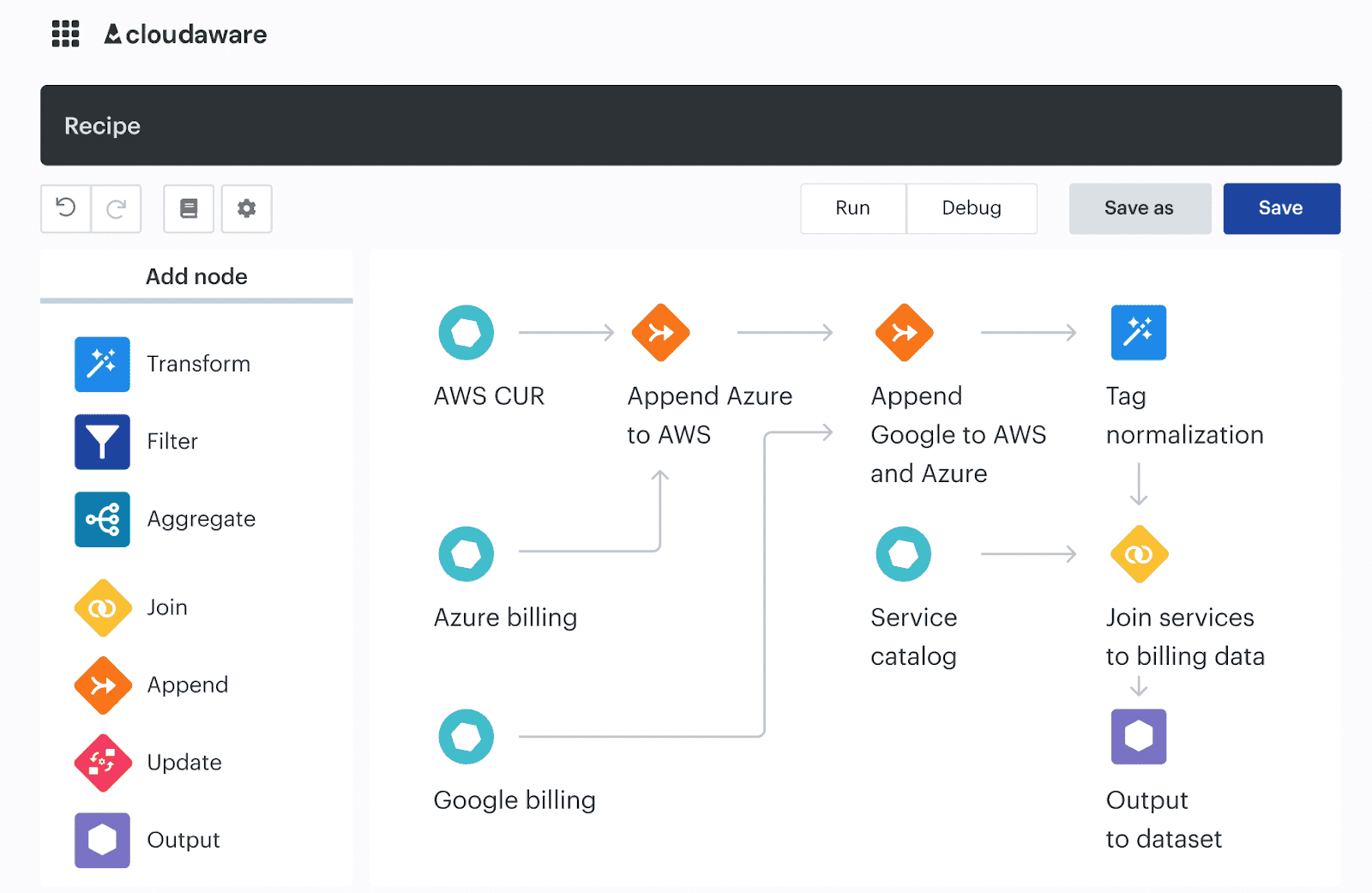

Here is an example of how the automation flow works (and you can control it):

Workflow automation in Cloudaware. Have questions? Ask them on a live demo

You’ll know who owns what, when actions are triggered, and why decisions were made — all backed by CMDB relationships and scope metadata.

What does “augmented” mean for accountability?

It means accountability is real — not an afterthought.

Every cost-impacting event — a missed tag, a surprise spike, a dropped RI — gets tied to a real owner via Cloudaware’s scopes. You don’t need to ask “who created this?” The platform already knows, and it routes the alert before your invoice takes the hit. You stay in control. The system just handles the grunt work of tracking it all down.

Real benchmarks from Cloudaware users

| Outcome | Result |

|---|---|

| Forecast accuracy | Improved by 35% QoQ |

| Manual reporting time | Reduced by 75% |

| Anomaly response | Cut from 3+ days to under 6 hours |

| Commitment utilization | Increased by 22% in 2 cycles |

| Cloud waste | Reduced by 50% in the first month |

These aren’t aspirational — they’re operational. They’re what happens when augmented FinOps stops being an idea and starts being part of how your cloud runs.

So here’s the bottom line: You don’t lose control — you gain leverage. You keep the decision-making power. The system just helps you make those decisions faster, with cleaner data, and with built-in accountability from the start.

How to implement augmented FinOps to your infrastructure

Do you want cost optimization that actually scales with your cloud, you can’t duct tape reports together and call it strategy? You need a system that sees your infrastructure the way you do — by scope, by service, by team — and knows when to act, not just when to alert.

Implementing augmented FinOps with Cloudaware means threading smart workflows through your real delivery motion. We’re talking tagging enforcement driven by policy. Forecast dashboards scoped to actual usage. Commitment planning that surfaces RI opportunities while there’s still time to save.

And yes, alerts that land in Slack before cloud cost gets out of hand.

This isn’t theory — it’s tech that’s already working inside teams who got tired of chasing invoices and started building FinOps directly into their deployment flow. Let’s walk through how to do the same.

1. Discovery: find the pain, then set the goals

Before you switch on any automation, you need one thing: clarity. Discovery helps you pinpoint where automation will create the fastest wins — whether it’s untagged resources hiding in reports, commitment waste no one’s flagged, or alerts that arrive days too late. No guessing. Just proof.

This isn’t a long process — just one focused week. But it changes everything.

Start your Cloudaware discovery with the system side:

- Scan cross-cloud cost dashboards to spot your top spenders by scope, product, or team.

- Run a tagging completeness report — zero in on missing

env,owner, andproducttags. - Check the last 90 days of anomaly trends and commitment waste.

- Review open policy violations that haven’t been remediated.

FinOps dashboard in Cloudaware with all the data about spenders.

Then talk to the people who feel the pain firsthand:

- Ask Finance where cost management slows down.

- Ask DevOps which cloud services are hard to trace or tag.

- Ask product teams what reporting gaps kill visibility.

You’re looking for friction — the stuff everyone works around but no one has time to fix.

And once you see it, the path becomes obvious. If tagging’s broken, that’s where enforcement goes first. If you’re missing Savings Plan coverage, spin up commitment planning. If anomalies take too long to surface, configure alerts by scope and role.

You’re not trying to fix everything at once. You’re finding the one or two pressure points where cost optimization, automation, and visibility will unlock momentum. That’s the power of a real discovery sprint — and the reason Cloudaware makes this step feel less like work, and more like insight.

2. Define goals, scope, and KPIs

Once you’ve surfaced the real friction in your cloud, it’s time to define goals, scope, and KPIs — not in theory, but in ways that map directly to what teams are dealing with day to day.

This step is where your augmented FinOps setup gets its backbone. Because automation without intent? That’s just noise. You need goals that are sharp, measurable, and grounded in your actual operating reality.

Start by reviewing the hotspots you found during discovery — then translate them into goals with teeth.

- If tagging was a mess across production workloads, define it: “Increase tagging completeness to 90% across all prod environments by Q2.”

- If anomaly alerts were late or siloed: “*Detect cloud spend anomalies within 24 hours for any BU exceeding $10K/month.*”

- If commitment planning is reactive: “*Automate RI/SP recommendations with at least 80% approval accuracy across compute services.*”

And don’t forget scope. Are you targeting one cloud provider or three? Are you rolling this out by business unit, team, or environment? Scoping keeps your rollout strategic — not sprawling.

Here’s the piece most folks skip: connect every goal to a pain point someone actually feels. Tie every goal to a stakeholder pain point, not just cost.

Because when DevOps leads see fewer tickets, when Finance gets clean, scoped reports without asking, when product owners stop getting tagged for someone else’s resources — that’s when augmented FinOps clicks.

And don’t overdo it. Three to five high-impact KPIs is enough to steer your initial rollout. Track them in Cloudaware’s dashboards from day one — because if you can’t measure it, you’re not optimizing it. You’re just watching it happen.

This step is about giving your FinOps crew a shared target — and your cloud the accountability it’s been missing.

3. Form your FinOps team

It’s about getting the right humans in the right roles, so automation doesn’t get stuck in “sounds great” and never land. You’re assembling a tactical working group that knows the cloud inside and out — and isn’t afraid to make cost accountability part of the culture.

Here’s the core crew I always recommend when rolling this out in Cloudaware:

- FinOps Lead – This is your quarterback. They own the lifecycle, align strategy with operations, and configure workflows in the platform. They're also the one who gets the Slack messages when anomaly alerts fire at 6:47am.

- Finance Partner – Not just for budget approvals. This person understands forecast pressure, cost allocation models, and what your chief officer wants to see at the end of the quarter. They’ll drive KPI alignment and reporting needs.

- Cloud Architect or DevOps Lead – These are your deployment ninjas. They know which cloud services are being used and why. They tag resources (or make sure others do), respond to alerts, and help design automation that doesn’t disrupt velocity.

- Product or Business Unit Lead – If cost rolls up to them, they’re in the loop. They provide context for usage patterns, help scope dashboards, and ultimately make prioritization calls when trade-offs are required.

Now — and this is key — get them all in the same room once a month. Not just to report numbers, but to review scope-specific insights, tagging trends, cost spikes, and optimization wins. That meeting isn’t overhead — it’s the glue that keeps FinOps connected to reality.

And once a quarter? Pull in your chief officer or VP-level sponsor. Let them see where FinOps is driving results — and where bottlenecks still live.

You don’t need a massive task force. But you do need cross-functional alignment, clear roles, and one person accountable for making Cloudaware hum.

4. Connect billing & infrastructure sources

If you’re serious about cloud cost visibility, this is non-negotiable. You need a clean, centralized foundation that Cloudaware can use to map cost, usage, ownership, and behavior across your entire environment.

Here’s what you want to hook up:

- For AWS: integrate your Cost and Usage Reports (CUR), configure billing export, and apply IAM policies to give Cloudaware access to spend, resource metadata, and tagging data. This unlocks anomaly detection, Reserved Instance modeling, and resource-level insights.

- For Azure: bring in EA billing APIs or subscription-level exports. Connect scopes to your management groups and tags to services. Azure-specific integration opens the door for automated cost alerts, scope-aligned reports, and tagging enforcement at the subscription layer.

- For GCP: wire in your BigQuery billing export. Tag your GCE workloads and connect them to scopes in the CMDB. This fuels your dashboarding, forecasting, and tagging compliance across projects.

The same flow works for Oracle and Alibaba cloud.

Then, pull in your infrastructure layer. Cloudaware’s CMDB will import all your deployed cloud services, group them by environment, and let you define scopes — think apps, teams, business units, or any structure that reflects how your cloud really works.

This is what lets you say, “I want daily burn rate alerts for this team,” or “Show me untagged storage linked to product workloads only.” Without these connections, you're stuck managing data islands. Once connected, you’re driving unified, real-time FinOps workflows with full-stack context.

Iurii Khokhriakov, Technical Account Manager at Cloudaware:

5. Clean up tags with a tagging uplift sprint

Start by choosing your critical metadata fields. Most Cloudaware users start with these five: env, owner, app, cost-center, and scope. These aren’t just labels — they’re what allow the system to tie resources to real teams, policies, and dashboards.

Then comes the magic: Cloudaware runs a Tagging Completeness Report across all your resources — scoped by project, environment, or BU — and shows you exactly where gaps exist.

You’ll see which teams are consistently tagging, which services are slipping through, and which workloads need attention.

Element of the tagging report in Cloudaware. Schedule a demo to see it live

From there, the Compliance Engine takes over:

- It flags missing or invalid tags in real time.

- It can auto-generate Jira tickets or Slack alerts tied to the exact resource.

- It enriches tag values using CMDB relationships — like auto-assigning

ownerbased on scope or existing asset data. - It tracks cleanup progress over time so you can report on improvement, not just effort.

What's left for you? Two things:

- Confirm edge cases: Make sure shared resources or temporary services are tagged in a way that reflects their actual purpose. Automation covers the bulk, but human context catches the weird stuff.

- Assign accountability: Cloudaware shows which product teams or owners need to act. You don’t have to chase — just nudge where needed and let the system keep score.

And here's the pro move: schedule weekly tagging scorecards to go straight to team leads. No confrontation. Just visibility. Once it’s on the radar, things start moving fast.

6. Deliver quick wins in the first month

You don’t need to launch full automation just yet. Use what Cloudaware already gives you out of the box — and make it real.

- Start with daily cost visibility. Set up automated spend emails scoped to each BU lead or DevOps owner. These aren’t just generic cost summaries — they’re broken down by scope, environment, and application, tied to tagging data and updated daily. People start seeing where their cloud cost lives without having to log in or ask for a report.

- Then turn on real-time anomaly detection. Cloudaware monitors usage baselines and flags deviations across services — and routes alerts straight to Slack or Jira, scoped to the team responsible. No delays. No guessing. Just “hey, your spend in

prod-eu-westjumped 26% overnight — here's the resource.” - And finally, roll out cross-cloud dashboards for finance and leadership. These aren’t vanity charts. They’re scoped, filterable, and reflect how your cloud is structured — product lines, environments, business units. Finance gets trendlines. Cloud architects get daily burn rates. DevOps gets visibility into what they launched last week — and what’s still running today.

These early signals do two things: prove value instantly, without anyone needing to learn a new tool, and unlock conversations — real ones — about where automation should go next.

Because once someone sees their cost go up… or sees they’ve been running unused services for three weeks… they don’t need convincing. They just ask, “Can we automate the cleanup too?”

7. Turn on augmented FinOps features

Up to this point, you’ve been building the runway — now it’s time to let Cloudaware lift the whole thing into motion. You’ve got your scopes in place, your data connected, tagging cleaned up, and a few signals running. Now we activate the automation that makes this system actually work without chasing people all day.

👉 Let’s start with waste detection. Cloudaware comes with over 100 pre-built policies — from idle EBS volumes and unused IPs to stopped instances and unattached load balancers.

An example of the waste detection dashboard in Cloudaware.

These aren’t static — you can customize thresholds. Want to flag idle storage after 7 days instead of 10? Done. Want alerts scoped only to production workloads? Easy.

You’re not just pointing at waste — you’re flagging it with context that matters to the team who owns it.

👉 Next, roll out commitment optimization. The RI/SP planner watches actual usage and surfaces commitment opportunities before your discount windows slip away.

It doesn’t just suggest a number — it scopes the recommendation by environment, ties it to team-level patterns, and pushes alerts to the right stakeholders. The teams still approve, but the heavy lifting — trend analysis, savings estimation, cost modeling — that’s handled.

👉 Then there’s forecasting and anomaly detection — the layer that makes you look like you see the future. You can forecast by BU, app, or product line — monthly, quarterly, however your finance cycle runs.

And when actuals drift more than 15% from forecast? Cloudaware flags the variance immediately.

Anomaly detection dashboard in Cloudaware. Schedule a demo to see it live

Not at month-end. Not when someone spots it manually. Immediately. With alerts routed to Slack, email, or Jira, scoped by CMDB ownership.

👉 Finally, take tagging automation to the next level. You already kicked this off during the uplift sprint — now it’s time to operationalize it. In Cloudaware, that means enabling field updates in the CMDB to automatically enrich missing metadata.

Let’s say a resource is tagged with app and env, but missing owner — the system uses existing relationships to backfill it. It’s metadata-as-a-service, and it keeps your tagging posture strong even when teams forget the details.

This is where traditional FinOps stops. But augmented FinOps? This is where it kicks in — with workflows that make cost signals feel like part of daily operations, not quarterly cleanups.

Turn the features on. Let them run. And trust the system you’ve built to start doing the heavy lifting — exactly the way it was meant to.

8. Create role-based dashboards and reports

This step is about building role-based dashboards and scoped reports — the kind that don’t just show data, but tell the right story to the right person at the right time.

- For Finance, start with a spend overview scoped by business unit. Include trendlines, blended and unblended cost views, and a forecast vs. actual panel that lets them see if they’re tracking to plan — not just watching the totals move.

- For Engineering, it’s all about the burn. They want daily spend broken down by service, real-time anomaly signals, and a visual of unused cloud resources that might still be costing them budget. If it shows what they launched, what’s idle, and what’s misconfigured — they’re in.

- For executives, you need high-level clarity. Think cost per app or team, quarterly trends, and top-spending environments. Keep it scoped, clean, and actionable — so they can glance at it and understand where the budget’s flowing and why.

The best part? You don’t need to build this alone. Cloudaware’s ITAM experts work with your FinOps team during onboarding to define the right views, connect them to real stakeholders, and make sure scopes, environments, and owners are aligned across every panel.

9. Embed FinOps into daily workflows

This is the step where augmented FinOps goes from “something we review every Friday” to “something that quietly keeps us on track every single day.” Because real cloud cost governance doesn’t work as a side project. It works when it lives inside your delivery flow.

So here’s how we make that happen.

- First up: your CI/CD pipelines. Drop Cloudaware’s compliance checks right into the provisioning process. If someone spins up new infra without

env,owner, orscope? It gets flagged before it ever hits your invoice. You’re not blocking builds (unless you want to). You’re just giving teams a heads-up — like, “Hey, this one’s missing a tag. Wanna fix it now or let the policy engine create a ticket for you?” - Next, turn on real-time alerts for misconfigured resources. A service launches without a scope? Someone skips tagging a new instance? Boom — Slack ping or Jira ticket, routed directly to the person who owns it. You don’t even have to think about it.

And here's the real pro tip: layer in auto-routing or remediation logic. You set the thresholds — like, “flag anything idle for 10+ days in prod” — and the system does the rest. Central FinOps doesn’t have to chase down every misstep. The alerts find their owners. The fixes get tracked. The loop closes itself.

10. Track KPIs & report progress

- Start with tagging completeness. Cloudaware breaks it down so clean it’s almost satisfying — you’ll see exactly which scopes are trending up week over week, which teams are consistently tagging right, and where enforcement still needs a little push. Not just a big fat percentage — scoped, segmented, and ready to act on.

- Then go check out your waste savings. This part is so satisfying. Every time Cloudaware flags an idle EBS volume, cleans up an orphaned IP, or catches a misconfigured instance? That action is logged, scoped, and tied to a real owner. The platform even tallies up the exact savings. No fluff — just here’s what we fixed, here’s what it saved you.

- Want to keep Finance happy? Pull up the forecast variance report. You’ll know exactly when your actuals start drifting, which teams are consistently on target, and where you need to fine-tune projections. The data’s already there — you’re just looking at it in the right light now.

- Commitment coverage? Oh yeah — it’s all there. Dashboards show you RI and SP utilization by region, family, and team. And you can even see how often your engineers accept Cloudaware’s commit recommendations. That’s a quiet trust signal right there — it means they’re starting to lean on the system because it’s getting it right.

- Also? Don’t sleep on anomaly resolution time. It’s one thing to flag a spike — it’s another to track how fast it got routed, responded to, and resolved. Cloudaware gives you the full timeline so you can measure not just alerts, but reaction time.

And here’s the part I seriously love: everything’s exportable, schedulable, and totally role-aware.

Want to send your FinOps Council a weekly summary? Easy.

Need to give your VP a clean, scoped exec view without the noise? Already done.

No spreadsheets. No pivot tables. Just the right metrics, landing with the right people, right when they need it.

Top 3 best practices of augmented FinOps from our experts

These aren’t just general tips — they’re field-tested best practices straight from the trenches, shared by the FinOps and ITAM experts behind some of the sharpest cloud cost automation rollouts I’ve seen.

We’re talking about the subtle, powerful moves that turn good automation into great operations. Like tuning waste policies based on drift. Routing insights to real owners, not shared channels. And structuring scopes to reflect how your teams actually run cloud services — not just how cost centers are labeled in a spreadsheet.

Run FinOps automation with human-in-the-loop checkpoints

Mikhail Malamud Cloudaware GM

I love automation as much as anyone — but if you’re pushing cost-impacting actions without human checkpoints, you’re not doing augmented FinOps. You’re just speeding up traditional FinOps and crossing your fingers.

The real move? Build your automation with approval gates that reflect how decisions are actually made. In Cloudaware, we scope RI/SP recommendations by environment and owner, and route them through pre-set thresholds before they ever hit execution.

Same with forecast scenarios — we flag deltas, but finance or product leads still get final say. Even auto-remediation rules, like terminating idle resources, should respect team boundaries and review windows. You want speed, sure — but speed with alignment. That’s what makes automation feel like a trusted partner, not an unpredictable bot.

Treat scopes as strategic assets, not just filters

Anna, ITAM expert

If you’re treating scopes like just another filter on a dashboard, you’re leaving so much FinOps power on the table. Scopes in Cloudaware aren’t visual — they’re structural. They define accountability, control anomaly routing, shape tagging audits, and drive lifecycle tracking.

I always tell teams: design your scopes around how decisions actually get made — who owns the spend, who owns the fix, who owns the ‘yes.’ Don’t mirror your org chart; mirror your execution flow.

When scopes are tied to real ownership, they become the anchor for cost accountability across budgeting, policy enforcement, and reporting. It’s what makes automated insights land with the right person — and not drown in a shared inbox. Scopes are the connective tissue between real decisions and automation that sticks.

Link CMDB ownership data directly to cost signals

Kristina, Seniour ITAM expert

Here’s the truth no one tells you when you first start building out augmented FinOps: alerts aren’t the goal — precision alerts are. If every cost anomaly or tagging violation ends up dumped into a shared Slack channel, it won’t take long before everyone mutes it.

That’s where your CMDB becomes your secret weapon. In Cloudaware, we tie every cost signal — waste, forecast drift, tag gaps — back to ownership using CMDB relationships. That means a spike in cloud storage spend doesn’t go to FinOps; it goes straight to the app owner who deployed that environment.

A missed tag? It’s routed to the actual service team, not escalated up to some centralized black hole.

And when forecast deviations hit a certain threshold, they trigger scoped workflows that match how you’ve structured your BU or environment strategy. This is where tech and trust meet — because when alerts feel personal, people respond.

Implement augmented FinOps with Cloudaware solutions

If you’re building an augmented FinOps motion that actually scales with your cloud, let me save you a year of duct tape and dashboard regret: Cloudaware is the platform built for it.

No black-box AI. No overengineered setup. Just agentless integrations that plug directly into your cloud services — and start surfacing insight from day one. Whether you're running AWS, Azure, GCP, OCI, Alibaba or IBM Cloud, Cloudaware connects to all of them, pulls billing and infrastructure metadata in real time, and threads it through the workflows you already use.

And the best part? It doesn’t stop at visibility. It’s wired for cost optimization at scale. Here’s what you get:

✅ Cross-cloud anomaly detection scoped by business unit, product, or environment.

✅ Commitment planning with RI/SP recommendations based on actual usage patterns.

✅ Tagging enforcement with auto-remediation, ticket creation, and compliance tracking.

✅ Forecasting dashboards by team, cloud account, or app — with variance alerts built in.

✅ Waste detection using 100+ policies — from idle volumes to unassigned IPs.

✅ Role-based dashboards for Finance, Engineering, and Execs — scoped, scheduled, and live.

And because it’s built on Force.com, you’ve got ready-made integrations with your tech stack: Slack, Jira, Terraform, ServiceNow, GitHub — all the stuff your teams already live in. Alerts go where the work is. So does tagging, remediation, and forecast approvals.

You’re not adding another platform to the pile — you’re connecting FinOps to reality.