Ever had a Monday where your CFO’s pinging about a $300K surprise in your AWS bill, Azure’s forecast dashboard is throwing confetti at “95% committed spend utilization,” and your engineers swear tagging that Kubernetes cluster was “on the backlog”? Welcome to life without a battle-tested FinOps framework.

I’ve spent over a decade in the trenches with my team — FinOps managers, cloud architects, DevOps leads — untangling hybrid spend messes across thousands of cloud accounts, patching rogue cost centers, and building governance straight into Terraform pipelines.

This isn’t textbook theory; it’s hard-won experience.

In this guide, I’ll break down:

the FinOps framework overview,

- expose the top 10 mistakes multi-cloud teams make (like skipping anomaly thresholds or misaligning chargebacks),

- and share how to dodge them with pro-level fixes

- plus killer tips for tagging, forecasting, and embedding accountability that actually sticks.

Grab your coffee. Let’s make your cloud spend boring (in the best way possible).

What is FinOps framework

The FinOps framework is basically the operating manual for how we run financial management in the cloud (and on-prem too). It’s not just some pretty diagram; it’s how we line up our tech usage, cost, and business goals so we’re not left explaining surprise seven-figure invoices to the CFO.

At its heart, this framework gives organizations a way to align all their teams — engineering, finance, product, procurement — so they make smarter, faster decisions about resources. Instead of chasing down idle EBS volumes or explaining why Azure SQL instances are burning $100K while doing absolutely nothing, we get ahead of it.

Components of the FinOps process

Let me break it down like I would over a glass of wine after yet another exec review:

✨ Principles: These are the ground rules. Things like “business value drives technology choices,” “everyone owns their usage,” and “FinOps data needs to be timely and dead accurate.” It’s how we make sure nobody’s spinning up a monster GPU cluster without thinking through the bill.

✨ Personas: Picture your finance manager reconciling consolidated invoices, your DevOps folks setting rightsizing automation, or your FinOps analyst watching RI utilization like a hawk. The framework recognizes all of them — their roles, goals, and headaches — so collaboration actually sticks.

✨ The FinOps lifecycle phases:

- Inform: Get crystal clear visibility. Collect billing, usage, tagging data across AWS, Azure, GCP, plus on-prem licensing. Build that showback dashboard that stops arguments dead.

- Optimize: Take action. Automate rightsizing, buy savings plans, tune Kubernetes node pools, squash zombie workloads.

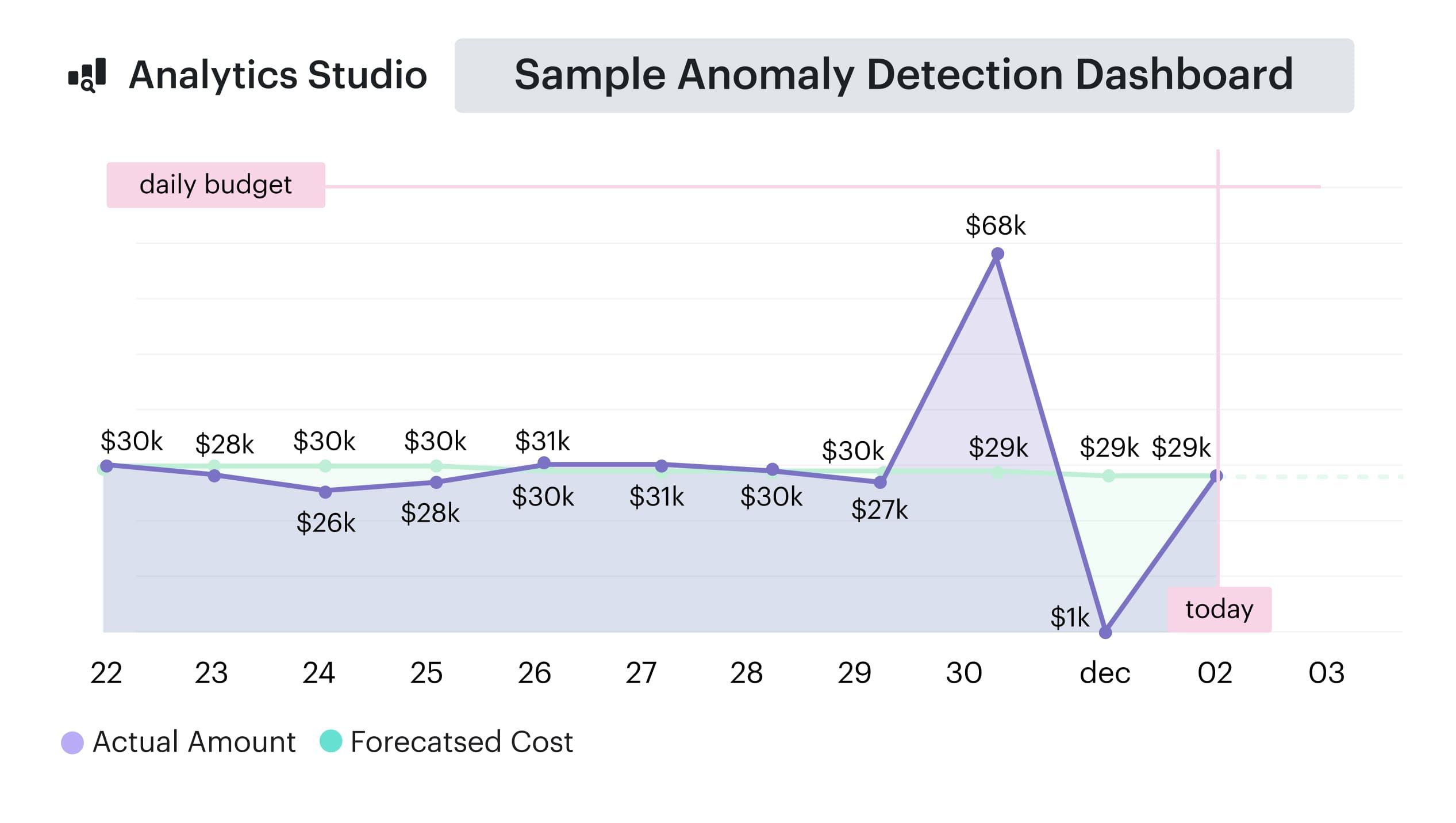

- Operate: Govern and mature. Set policy with your cost anomaly thresholds, automate chargebacks, and track your maturity so you evolve from crawling (50% allocation) to running (full cross-cloud allocation + predictive forecasting).

✨ Domains & Capabilities: This is where it gets real. Think anomaly management, benchmarking, rate optimization, licensing strategy, andeven cloud sustainability. Each capability plugs into your goals — whether that’s driving down blended cloud cost, improving commitment coverage, or forecasting spend to 90% accuracy.

Read also: What Is FinOps? Framework, Roles, Strategy & Tools in 2026

Why it matters

Between chasing AWS EC2 sprawl, trying to predict Azure EA usage with confidence, and splitting shared costs for GCP BigQuery workloads that finance can’t trace, most teams are living in a game of catch-up. You’re knee-deep in anomaly management, trying to spot that EBS volume idling for 92 days, or reconciling SaaS licensing so your ITAM report doesn’t trigger a CFO meltdown.

Here’s why the FinOps framework changes the game:

👉 It gives every stakeholder the same playbook. Whether it’s your finance manager setting effective cost KPIs, your DevOps engineer automating Kubernetes rightsizing, or you forecasting spend on committed use discounts, you’re all speaking one language. No more blind spots where engineers see “faster delivery,” finance sees “budget crater,” and no one owns the usage.

👉 It’s proven to slash waste. 68% of organizations say they waste significant cloud spend — roughly 28% of their entire bill. That’s your margin, your headcount plans, your innovation budget, literally evaporating because there’s no shared approach.

👉 It keeps your optimization from stalling. The FinOps framework brings structure to your lifecycle:

- Inform: so you know exactly where costs come from, down to tag-level usage in your multi-account structure.

- Optimize: so your team doesn’t buy RIs for workloads that get deprecated six months later.

- Operate: so your cost governance, chargebacks, and anomaly policies run on autopilot — not monthly CSV heroics.

👉 It accelerates maturity so you can actually sleep at night. With the framework, you move from “guesswork” to granular cost allocation, proactive forecasting, and rate optimization that isn’t left to manual scripts. Gartner found organizations with mature FinOps save up to 30% on cloud spend within the first year. That’s your next product launch, your security upgrades, or your bonus pool right there.

I’ve been in those QBRs where the finance head’s eyebrows shoot up because your EDP credits didn’t post in time, tanking effective cost models across the board. I’ve watched cloud architects scramble to justify commitments that overrun by 40% because no one aligned forecasts to product roadmaps.

That’s exactly why the cloud FinOps framework matters. It turns chaos into coordinated action. It aligns your usage, costs, and goals across every stakeholder. Furthermore, it gives your DevOps team automation guardrails, your finance team predictability, and your product org the freedom to scale — all while keeping your multi-cloud, on-prem, and SaaS footprint humming without nasty surprises.

Trend #1: Moving from Cloud-only to Cloud+ (Scopes)

The smartest organizations are treating FinOps like a universal toolkit, applying it beyond EC2, GKE, and Azure VMs — into licensing, SaaS sprawl, data centers, hybrid workloads, all under the same financial management guardrails. Same principles: unit economics, showback, shared accountability. Just expanded across every type of resource and service eating your budget.

And the framework itself now bakes this in with explicit Scopes. That means you’re no longer forcing your on-prem or licensing spend through awkward cloud-only models. You can split things out:

- build one scope for AI GPU workloads (because who wants a single invoice line item hiding millions?),

- another for Oracle or Atlassian licensing or any other cloud with totally different lifecycle, capabilities, and maturity metrics,

- and keep cloud optimization humming in its own lane.

Why’s this so important for you and me? Because trying to track AWS Savings Plans, Kubernetes node pool usage, and 500 SaaS contracts under one blended chart is a financial time bomb. I’ve seen forecasts slip by millions because no one separated licensing commitments from actual deployment needs.

It’s why Booking.com extended their forecasting beyond public cloud cost, right into data centers — so infra teams and finance weren’t arguing over partial CapEx vs OpEx allocations. Or how Under Armour’s FinOps lead literally splits focus 50/50 between cloud spend and software licensing. They set different owners, different KPIs, so nothing gets buried.

If your dashboards still toss everything into “other costs,” it might be time to borrow a page from these leaders. Start by defining just one new scope — maybe the software contracts that keep tripping up your DevOps usage plans. Give it a clear owner, track unique KPIs, and plan cost optimization around how your teams actually consume.

Because that’s the heart of modern FinOps: making sure your spend, wherever it lives, is driving real business outcomes — with zero ugly surprises at quarter close. And trust me, that’s a lot more fun to review over coffee than explaining why your multi-cloud EDP credits posted late and tanked your effective cost model.

Read also: Choose an ideal ITAM software: Top 15 asset management tools

Trend #2: Building multi-speed FinOps maturity across domains

Here’s one of my absolute favorite shifts we’re seeing in the FinOps foundation framework world — because it’s saving so many teams from burnout, wasted cycles, and some spectacular month-end surprises.

The trend? It’s all about building multi-speed FinOps maturity across domains.

Meaning: organizations aren’t trying to force every single FinOps capability to hit “run” at the same time. They’re being strategic, using the maturity model to crawl, walk, or run differently across each domain — based on what’s actually critical for their architecture, cost drivers, and product roadmap.

Take Caterpillar case. They’re not chasing anomaly detection or fancy forecasting dashboards for SaaS right out of the gate. They started with the basics: data ingestion and allocation — because if you can’t split that $2 million SaaS bill across your teams and products, good luck optimizing or forecasting later.

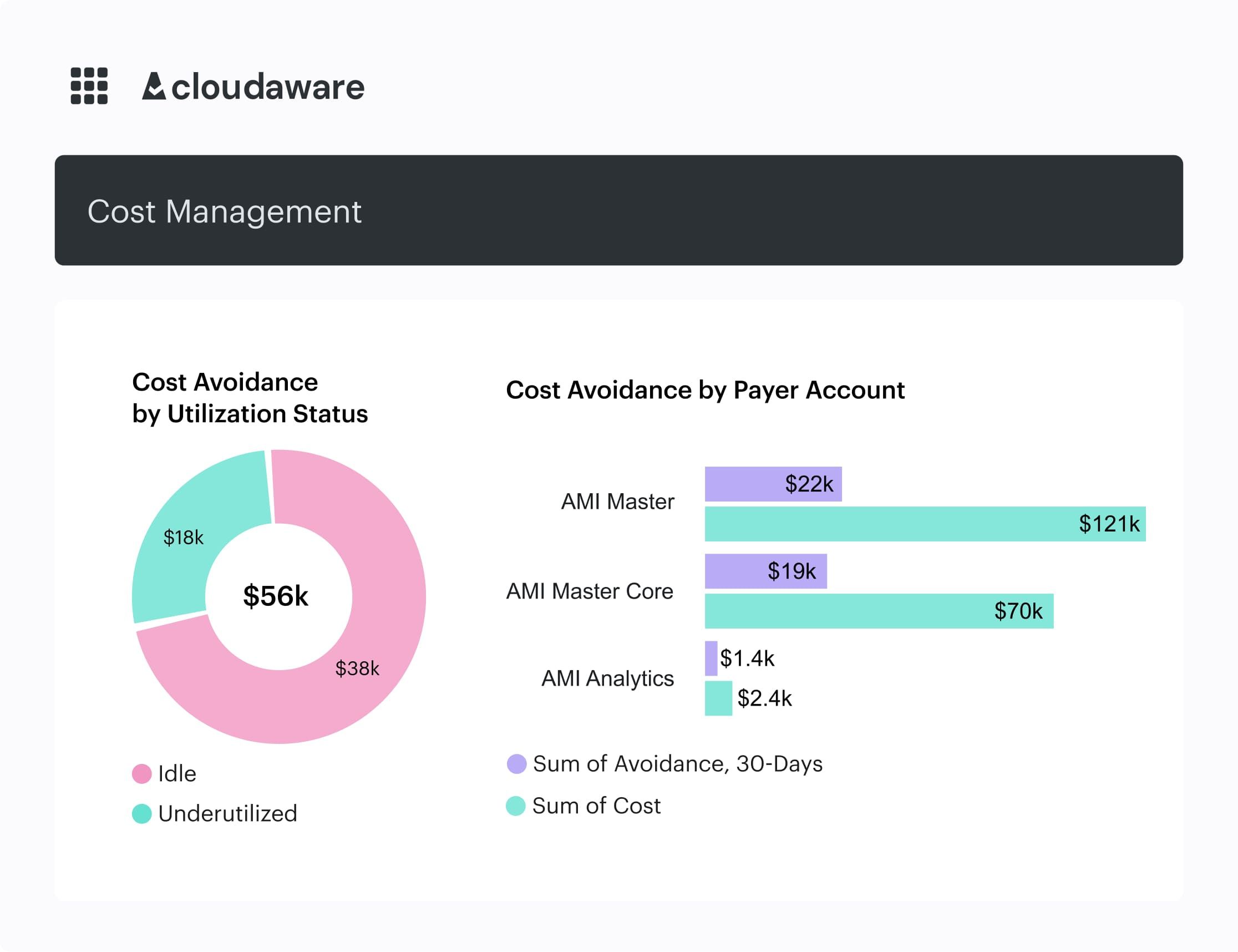

FinOps dashboard in Cloudaware. Schedule demo to see it live.

Meanwhile, over at Booking.com, they’re already at “run” for public cloud financial forecasting, projecting workloads by environment and market, but still only “crawl” on data center allocation. And that’s by design — it keeps them focused on ROI instead of spreading thin.

So how do you bring this to life in your world — juggling AWS RI coverage, Azure EA rollovers, GCP node pool scaling, plus your on-prem and SaaS renewals?

Here’s how top organizations are doing it, step by step, using Cloudaware as their backbone:

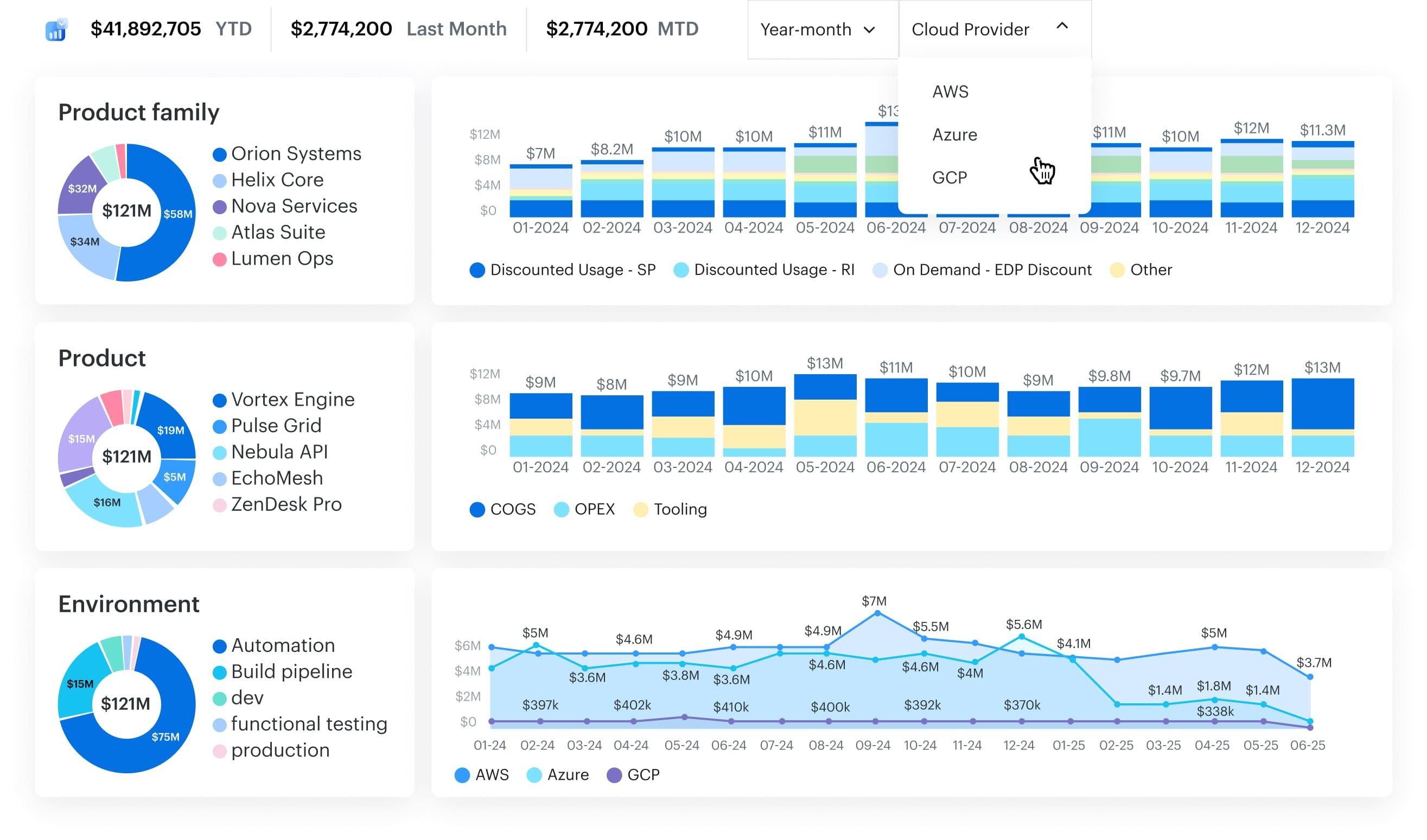

- Start with ingestion + allocation. Nail down where your usage and costs live. Use Cloudaware’s cross-cloud billing ingestion, tagging policies, and allocation views to split spend by product, team, or BU.

- Then add forecasting. Once your foundation’s solid, layer on forecast models — first by major cloud providers, then fold in on-prem and software licensing.

- Next, optimize. Spin up Compliance Engine rules to catch idle EBS volumes or underused Azure databases, and run targeted optimization on your top spend drivers.

- Finally, operate. Automate your chargebacks, anomaly alerts, and push maturity scoring across your different scopes — maybe you’re at “run” for cloud showback but still “crawl” for licensing anomaly tracking.

And honestly? That’s the smartest way to build a modern FinOps practice. You don’t need every scope or every capability at “run.” It’s about sequencing improvements where they move the needle most. This way, you can walk into your next exec review showing exactly how you tightened blended cloud cost, improved commitment utilization, or cleaned up SaaS shelfware — with clear, defensible KPIs that finance and engineering both trust.

Because that’s what the FinOps framework is all about: turning chaos into clarity so your teams make rock-solid decisions, your forecasts stay on track, and your CFO stops side-eyeing your spend curves. And yeah, that means you can actually log off on Friday without a last-minute dashboard scramble.

Trend #3: Increased automation and “FinOps for AI”

Here’s what’s new: organizations are doubling down on automation and weaving FinOps directly into how they handle AI from the ground up. And it’s not just hype. The latest data tied to the FinOps foundation shows 63% of teams are already managing AI spend, and by next year that’s expected to hit 96%. That means pretty soon, everyone’s going to be answering for their GPU line items.

So what’s actually changing?

Your peers are no longer waiting until the CFO sees a surprise $700K GPU charge and then scrambling for answers. They’re building AI-specific forecasting, anomaly detection, and policy-driven optimization right into their stacks.

It’s how Booking.com manages public cloud forecasting by product line even as they experiment with new ML models, and how Under Armour’s FinOps practice is already automating allocation of software licensing tied to AI workloads.

Let’s get real for a sec. If you’re juggling AWS EC2 cost forecasts, Azure RI utilization, GCP BigQuery spend — plus your teams just launched four new ML training pipelines on custom Nvidia clusters — you can’t keep treating it like any other usage. These AI resources scale differently, spike unpredictably, and if they aren’t broken out, they’ll bury your effective financial models.

Cost utilization report element from Cloudaware dashboard. Schedule demo to see it live.

Here’s how you can start implementing this with Cloudaware — and keep your team from chasing rogue GPU bills at quarter close:

✅ Break out AI as its own scope. Ingest billing + usage data across cloud and on-prem clusters, then use Cloudaware’s tagging rules to enforce “model,” “team,” and “BU” tags.

✅ Set AI-specific forecasts + anomaly thresholds. Don’t just lump it into general compute. Run daily Compliance Engine checks that flag if a single training job exceeds, say, 20% of your weekly projection.

✅ Embed guardrails into deployment. Use Cloudaware policies so new high-cost GPU nodes can’t launch without tags or pre-approved cost centers.

✅ Track maturity by capability. Maybe you’re at “run” for GPU forecasting, but still “crawl” on cost accountability for SaaS ML tools — and that’s fine. Just make sure you know where each sits in your maturity model so you can prioritize next steps.

Because that’s what this evolution of the FinOps framework is really about. Not just adding more charts. It’s about turning AI from a black hole on your cloud invoices into a clear, governed, predictable investment that your teams, finance partners, and execs can actually tie to business outcomes.

And trust me, the next time someone drops a “*why did our AI costs jump 3x this month?*” bomb in your QBR, you’ll be the calm one with the dashboards and policies to back it all up — while the rest of the room’s still hunting through line items.

Ready to get your AI & cloud spend under control?

Stop chasing GPU bills and mystery line items. Book a quick session with a Cloudaware FinOps expert.

We’ll dig into your exact tasks and pain points — from taming AWS, Azure, GCP, Oracle, Alibaba costs to breaking out forecasts. Then we’ll show you how Cloudaware’s FinOps turns chaos into clear, governed spend you’ll love.

Trends are new, but there are constant issues preventing your FinOps processes working. Below, you’ll find best practices on how to fix them.

Mistake #1: Treating FinOps as a “cloud-only” discipline when business strategy spans beyond

Way too many teams still treat FinOps like it’s just a cloud cost optimization side project for IT. They’re busy rightsizing EC2, tuning Azure RIs, maybe chasing a few GCP anomalies — meanwhile the business is expecting a full view that includes SaaS, on-prem licenses, even your new AI experiments. And because no one sets up proper scopes, huge expenses slip right through the cracks.

I’ve seen it happen over and over. You’re high-fiving about slicing $500K off AWS, but leadership’s still wondering why total tech spend keeps climbing. Turns out you’ve got $2M locked in underused SaaS and aging software contracts.

Without clear scopes tying it all together, forecasts get torpedoed, EBITDA misses happen, and those flashy growth plans suddenly stall.

How to fix it with Cloudaware:

✅ Spin up explicit scopes. Break out cloud, SaaS, on-prem, and AI as their own focus areas right in Cloudaware.

✅ Match KPIs and owners. Maybe your FinOps team runs RI optimization, ITAM tracks shelfware, and security handles compliance exposure — all with tailored metrics.

✅ Pull in every invoice and usage file. From AWS to Salesforce to Oracle — normalize it all so it’s apples-to-apples.

✅ Push unified dashboards. Now your CFO sees one clean story across total tech spend, not just your cloud slice.

Because honestly? That’s how top FinOps teams keep finance happy, IT focused, and the whole business steering toward actual growth — without ugly last-minute surprises. And yeah, it means you can walk into your next exec review calm, knowing you’ve got the full picture covered.

Mistake #2: Optimizing costs without aligning to product or revenue goals

Here is how it goes: your team’s crushing it on classic FinOps targets. You’ve got RI coverage dialed in across AWS, tuned Azure savings plans to near perfection, your dashboards show a beautiful drop in blended compute rates.

Finance is thrilled.

But then your product team quietly pushes back two launches because the environments they needed to be got downsized out of existence.

That’s the trap: optimizing costs without aligning to product or revenue goals.

It’s the fastest way to undercut the very growth you’re trying to protect. The FinOps foundation framework flags this as a core maturity gap. 68% of cloud waste isn’t just idle resources — it’s spend that’s completely decoupled from actual business or customer value. That means you could be cutting $600K a year from your cloud bills, but if it delays your key features or tanks uptime on revenue-critical APIs, it’s a net loss.

So how do you keep from falling into this? Here’s how smart teams are fixing it right now, using Cloudaware:

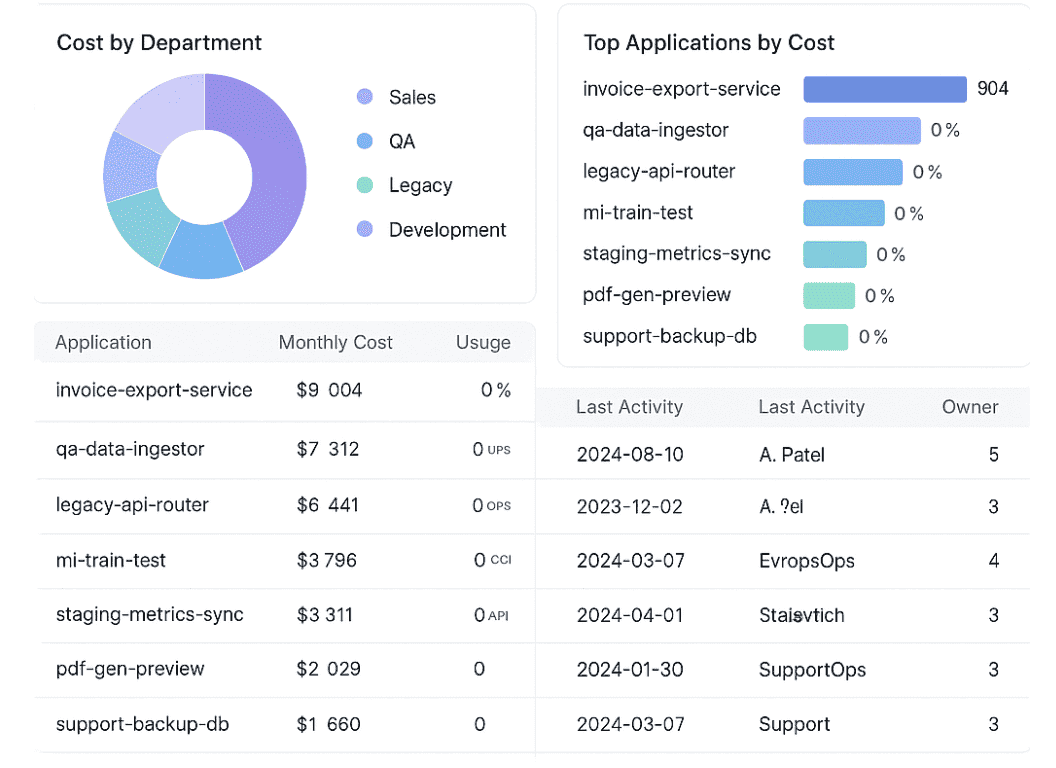

✅ Map scopes to product lines. Use Cloudaware to break out spend by core SaaS platform, customer-facing APIs, internal ML projects, even separate out innovation labs. This way, your optimization scopes tie directly to business lines.

✅ Track effective cost per outcome. Don’t stop at CPU or storage graphs. Build dashboards that show the cost to deliver each feature, or run per-customer workloads. Let finance and product see exactly what they’re funding.

✅ Use policy-driven guardrails. With Cloudaware’s Compliance Engine, set smart rules: block rightsizing or shutdown actions that would dip below SLA thresholds for critical services. Or auto-alert when spend cuts cross a defined performance floor tied to customer commitments.

✅ Get everyone the same view. Push these dashboards to your CFO, your product leads, your engineering directors. So the next time they debate roadmap priorities, you’ve got crystal-clear data showing how usage, cost, and customer impact all connect.

Because that’s what modern FinOps is about — using the framework to optimize spend, yes, but always in lockstep with what drives revenue, customer success, and long-term margins. That’s how you go from being the “cost police” to being the strategic powerhouse in the room. And trust me, that’s a story your whole exec team wants to keep hearing.

Read also: Cloud Cost Optimization Framework: 11 Steps to reducing spend in 2026

Mistake #3: Using one-size-fits-all maturity targets across scopes and domains

You’ve probably been there. Your AWS anomaly detection is running like a dream. You’ve tuned EC2 and RI optimization so well your finance team practically cheers. But over on the SaaS side? Your seat licenses are still managed in spreadsheets, shelfware is hiding everywhere, and your on-prem usage isn’t even mapped to products or BUs.

Meanwhile, leadership’s asking: “Why aren’t we automating all this equally? Shouldn’t we be at the same maturity for every scope?”

That’s the trap. Too many organizations try to force identical maturity targets across all domains in their cloud FinOps framework. They push for the same “run” level processes — automated chargebacks, anomaly alerts, detailed forecasts — on cloud, SaaS, on-prem, and AI, all at once.

It sounds clean. It looks beautiful in a slide deck. But in reality? It’s a recipe for diluted focus and wasted cycles.

The FinOps foundation framework is clear. Each domain demands its own path. Flexera’s 2024 numbers back it up. 68% of cloud cost waste still comes from teams spreading efforts thin — over-optimizing low-impact areas while massive leaks continue elsewhere.

So what’s the move? Here’s exactly how top teams fix it with Cloudaware:

✅ Start by defining distinct scopes. In Cloudaware, carve out scopes for your core cloud infrastructure, SaaS stack, on-prem licensing, and any AI experiments. Each gets its own pipeline for billing and usage ingestion.

✅ Set different maturity targets by scope. Maybe your cloud domain is at “run,” with granular forecasting, policy-driven cost alerts, and automated RI governance. Meanwhile, your SaaS scope stays at “crawl.” You focus purely on allocation and cleaning up seat usage before chasing anomaly detection.

FinOps dashboard in Cloudaware. Schedule demo to see it live.

✅ Tailor Compliance Engine rules to fit. For cloud, set rules to flag any service exceeding 15% above forecast weekly. For SaaS, keep it simpler — flag contracts close to renewal with under-50% utilization. For on-prem, maybe just monitor license expiry risk. Each control matches the data reality of its domain.

✅ Roll it up into unified dashboards. Use Cloudaware’s multi-scope views to show your CFO and product leads exactly where each stands — and why. They’ll see a deliberate, risk-aligned roadmap. Not a scattershot maturity chart.

Because that’s what real financial management under a FinOps framework looks like. You allocate your resources, time, and automation where they actually protect margins and delivery. Not chasing the same fancy anomaly detection everywhere just for symmetry.

That’s the story you want at your next review. Your teams are driving smarter decisions, reducing cloud cost, cleaning up SaaS waste, tightening on-prem compliance — each at the right pace. Perfectly tied back to your business goals. That’s how you build trust, hit targets, and keep your FinOps practice from turning into a one-size-fits-none circus.

Mistake #4: Ignoring sustainability or ESG cost accountability in tech financial strategy

You’ve got your cloud cost strategy humming. Your AWS blended rates are down, Azure RI coverage is sitting at 80%, GCP anomaly detection is flagging spend spikes before they balloon. Meanwhile, your DevOps team is busy running usage cleanups on Kubernetes clusters, and your ITAM folks are auditing on-prem licensing compliance. Feels like the FinOps framework dream, right?

But then the board meeting hits. Suddenly, your CFO is side-eyeing you while your Chief Sustainability Officer is asking, “Great that we’re cutting costs, but what’s our actual carbon impact this quarter? How does this align to our ESG targets tied to financing?”

That’s where it unravels. Because so many teams ignore sustainability or ESG cost accountability inside their financial management strategy. It’s not just an optics issue. Gartner’s latest research shows by 2026, 75% of large enterprises will demand carbon transparency from their tech partners.

If your dashboards and FinOps metrics can’t tie spend to carbon impact, your next audit — or investor pitch — is already on shaky ground.

So how do you fix it, without drowning under even more reporting chaos? Here’s exactly how smart teams are doing it in Cloudaware:

✅ Define scopes that factor ESG alongside cost. In Cloudaware, set up scopes not just by BU or environment, but by ESG-critical workloads. Maybe you break out GPU-heavy AI training clusters, test environments that rarely sunset, or that aging on-prem gear. Now you can track these alongside your standard cloud scopes.

✅ Use Compliance Engine for ESG + cost controls. Don’t just flag idle resources for budget waste. Build rules that surface underutilized VMs or clusters that are also driving your highest carbon intensity. You’ll catch double inefficiencies — cost and environmental.

✅ Tie it to usage and business goals. Overlay your dashboards so your sustainability KPIs live right next to your cloud cost and service utilization metrics. That means finance, DevOps, product, and your ESG office all see the same truth. Now when someone wants to spin up a new data-intensive workload, you’ve got visibility into its financial and environmental footprint before approving.

✅ Advance maturity at the right pace. Maybe you start simple — tracking idle usage against sustainability flags. As your data matures, evolve into deeper ESG-linked forecasting and automated shutdowns of underutilized resources, aligned to both cost targets and carbon thresholds.

Because that’s what modern FinOps is evolving into. It’s not just about brilliant cost optimization. It’s building a framework where your financial strategy and sustainability goals drive the same decisions.

Read also: 10 Steps to IT Asset Management Strategy For Multi Cloud Setup

Mistake #5: Failing to embed FinOps into vendor, licensing, and AI procurement decisions

Here’s the problem. You’ve got your cloud environment under control. EC2 rightsizing is driving down waste, Azure Savings Plans are hitting sweet spot coverage, your SaaS seat allocations are finally mapped by BU. You’re running a slick FinOps process — tracking usage, tagging for chargebacks, pushing daily anomaly alerts.

But then finance comes along and locks in a multi-year AI licensing agreement based on aggressive sales pitches or high-level product ambitions. No one pulled your real data. Procurement renews a SaaS contract at peak headcount assumptions — ignoring the shelfware your dashboards have been flagging for six months.

That’s what happens when you fail to embed FinOps into vendor, licensing, and AI procurement decisions. It’s like optimizing your framework everywhere else, only to let giant cost commitments slide through with zero guardrails.

The waste isn’t theoretical either. Recent industry data shows over 68% of tech waste still stems from mismatches between contractual spend and actual workload needs. That’s your carefully tuned cost optimization instantly swallowed by a single bad contract.

So how do you fix it — in real, day-to-day steps your teams can use right now?

✅ Make FinOps a core checkpoint in every new vendor or licensing conversation. Before your CFO signs that next AI GPU deal or a three-year SaaS renewal, feed them real usage and forecast data from your Cloudaware dashboards. Show actual workloads, growth rates, and even recent rightsizing gains that lower their baseline needs.

✅ Run pre-procurement modeling in Cloudaware. Scope out what happens if workloads scale slower, or if your anomaly detection and auto-suspend policies cut idle use by 20% next quarter. Why lock in spend on stale assumptions? Your FinOps team can build multiple contract shape scenarios to show finance the risk.

✅ Tie contracts directly to optimization controls. Use Cloudaware’s Compliance Engine to track contract assumptions vs real usage. If that big AI cluster is only at 60% of the commit volume you signed for, you’ll catch it in Q1 — not at the renewal panic in year three.

✅ Share unified dashboards with all stakeholders. Bring procurement, finance, and engineering into the same truth. Let them see how licensing, reserved commit utilization, and on-prem resources all align to workloads and business goals.

Because that’s what a mature FinOps framework looks like. It doesn’t stop at usage-based optimization inside IT. It extends the same financial discipline to every decision — vendor contracts, multi-year licensing, GPU procurement — before someone locks in a commitment that buries your cloud cost wins.

And honestly? That’s how you go from being seen as the team that polices budgets to the strategic powerhouse keeping margins tight, growth predictable, and every vendor promise aligned to actual data. That’s the story you want to tell at your next exec review — and the one that builds trust across every corner of the business.

Implement FinOps framework with Cloudaware platform

Running a solid FinOps framework across today’s sprawling tech estates is brutal. Your teams are already chasing down untagged resources, explaining cost anomalies, juggling RI utilization, and trying to forecast across AWS, Azure, GCP, VMware, plus all those SaaS and on-prem stacks. Meanwhile, leadership wants every dollar tied cleanly back to actual business goals.

Cloudaware was built for exactly this. It’s an enterprise platform that gives organizations full-spectrum financial visibility and control — across cloud, data center, and hybrid workloads — all under one roof.

It ingests and normalizes billing, usage, and asset data from AWS, Azure, GCP, VMware, Kubernetes, and your SaaS + licensing contracts. That means no more stitching together half-baked spreadsheets just to see total spend or track underutilized instances.

With Cloudaware, you get:

- Unified cross-cloud billing analytics & forecasting

- Tag governance that keeps your environments clean

- Anomaly monitoring that flags usage spikes or drift before they blow up your budget

- RI and Savings Plan tracking tied to actual workloads

- Idle and oversized resource detection for pinpoint cost optimization

- Scope-based maturity dashboards that show where you’re crawling vs. running

- A powerful Compliance Engine to enforce your FinOps process across teams

This is why global finance, engineering, and DevOps leaders use Cloudaware to keep daily operations tight, budgets predictable, and strategic decisions fully backed by data. It transforms how you manage cloud cost, licensing, and every other corner of your tech spend — without surprises.